Baillie Gifford American Fund rebounds as growth names power long-term thesis

Mega-cap tech and founder-led growth companies anchor the £3.2 billion fund, which emphasizes a seven-year average holding period despite volatility

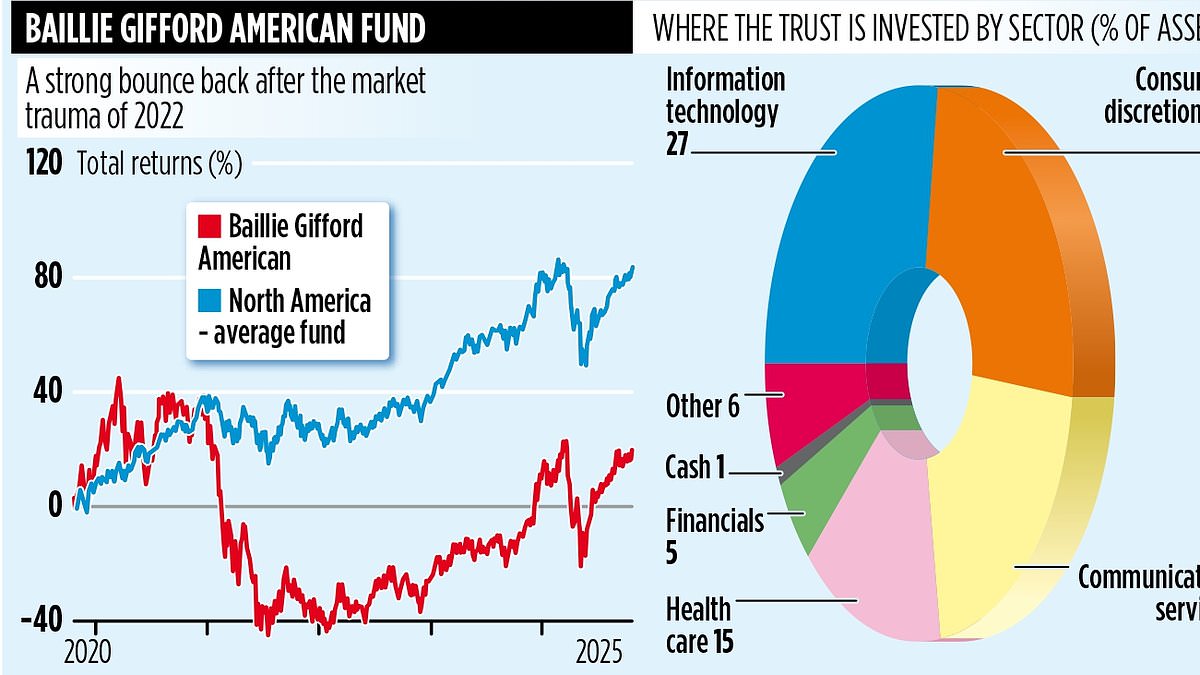

The Baillie Gifford American Fund, a £3.2 billion U.K.-listed vehicle launched in 1997 to pursue long-term growth in the United States, has logged a notable rebound after a difficult 2022. While the fund’s ten-year returns are around 431%, its more recent performance has been uneven: five-year returns of about 19% lag one-year gains of 29% and three-year gains of 73%.

Kirsty Gibson, one of four managers overseeing the 50-stock portfolio, says its performance has been volatile and that the fund is best viewed as a long-term investment. "When we invest in US businesses, it's with a five- to ten-year time horizon in mind. Our average holding period for individual stocks is around seven years and investors should look at the fund with a similar perspective," she said. The portfolio’s growth tilt is evident in its top holdings, including Amazon, Meta and Nvidia. Yet Gibson notes broader characteristics run through the lineup: about 70% of the companies are founder-led or founder-backed, producing a culture and long-term vision that she says aligns with patient, long-term investing.

Among the biggest stakes is DoorDash, the delivery company run by co-founder Tony Xu, which accounts for about 4.3% of the fund. Gibson met Xu earlier this month at a San Francisco investor conference, saying access to key individuals helps the team understand culture and strategic priorities. "It's imperative we get access to key individuals such as Tony Xu so that we can build strategic relationships and better understand the culture of the businesses we are invested in," she explained. "In the United States, DoorDash is on a mission to deliver everything – be it food, groceries or retail essentials – to anyone who lives in a city."

Cloudflare, another key holding, is led by co-founder Matthew Prince who Gibson says has a "clear vision" for the business with a big focus on artificial intelligence. While the fund remains focused on long-term opportunities, the managers keep a close eye on resilience when macro headwinds appear. For example, concerns about a potential slowdown in US consumer spending prompted some trimming rather than exits from positions such as Tesla and data-driven advertising specialist The Trade Desk.

The fund’s governance and structure also shape its approach. Based in Edinburgh, the investment team regularly crosses the Atlantic to visit companies and assess management and culture up close. All of the fund’s holdings are listed companies, unlike its sister investment trust Baillie Gifford US Growth, which has about 36% of assets in unquoted positions. The total annual fund charges are 0.52%. The fund is managed with a clear long-term orientation, and Gibson emphasizes that the objective remains delivering growth through exposure to blue-chip and newer growth-name opportunities alike, with a disciplined approach to risk.

In practice, the fund’s focus on founder-led growth and durable competitive advantages has helped it weather macro volatility and position itself for ongoing upside as major AI, cloud, and digital platform names continue to reshape the US market. The team’s emphasis on access to company founders and a willingness to engage deeply with management teams underpins its search for sustainable, long-run returns. The strategy’s current composition reflects a balance between mega-cap tech leaders and other high-growth firms with founder-led cultures, a combination that Gibson says has historically supported strong, long-run performance across cycles.