Baillie Gifford American Fund rebounds on long‑term tech bets

Edinburgh‑based U.S. growth fund focuses on founder‑led leaders and mega‑cap tech, maintaining a five‑to‑ten‑year horizon amid market volatility.

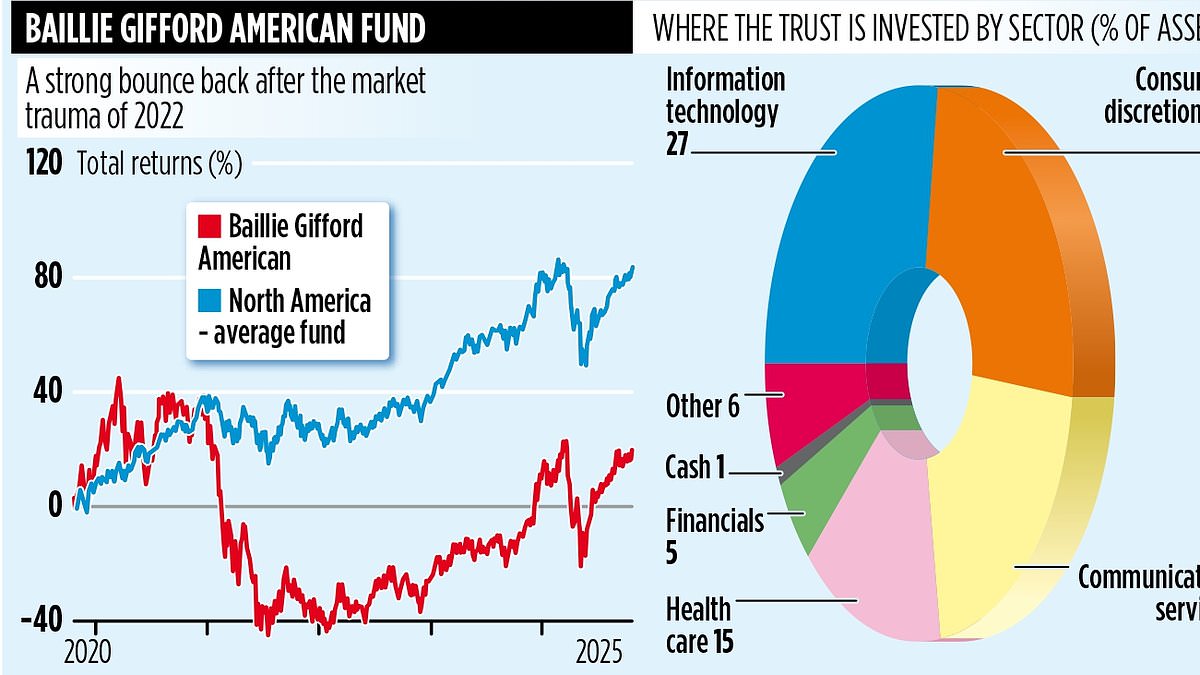

Baillie Gifford American Fund, the Edinburgh‑based U.K. growth vehicle focused on U.S. technology and related growth companies, has staged a pronounced rebound after a difficult 2022 and a volatile 2023. The £3.2 billion fund has built a long track record of strong returns over a decade, but its recent performance underscores how sensitive growth investing can be to macro shifts and rate cycles. Ten‑year returns run close to 431 percent, yet the fund’s five‑year return of around 19 percent lags the one‑ and three‑year metrics of roughly 29 percent and 73 percent respectively. Kirsty Gibson, one of four managers overseeing the 50‑stock portfolio, says the performance has been volatile and emphasizes the need for a long‑term perspective. 'When we invest in U.S. businesses, it’s with a five‑ to ten‑year time horizon in mind. Our average holding period for individual stocks is around seven years and investors should look at the fund with a similar perspective,' she notes.

Over the past seven years, the fund has delivered roughly 130 percent in total returns, underscoring its growth bias. Its emphasis tilts toward mega‑cap technology names alongside a broader set of innovative, founder‑led companies. Amazon, Meta Platforms and Nvidia appear among the top holdings, reflecting a preference for platforms, AI capability and scalable growth models. Yet Gibson and her colleagues point to a more nuanced theme: about 70 percent of the companies in the portfolio are led by their founders or by founders who retain significant stakes. That founder‑led DNA, they argue, can foster differentiated cultures and a long‑term strategic vision that aligns with patient, long‑term investing.

Among the founder‑led names is DoorDash, a frequent focal point for the fund. DoorDash accounts for about 4.3 percent of the portfolio, and Gibson said she met co‑founder Tony Xu earlier this month at an investor conference in San Francisco. She described DoorDash as more than a meal‑delivery service, noting its broader mission to deliver anything—food, groceries or retail essentials—to people living in cities. Another core holding is Cloudflare, the software company run by co‑founder Matthew Prince, whom Gibson says has a clear vision for the business with a strong emphasis on artificial intelligence. While the fund’s long horizon remains intact, managers stay alert to macro headwinds and their potential impact on consumer spending. In light of concerns about a possible slowdown in U.S. consumer activity, the fund has trimmed some holdings—though not exited—such as Tesla and The Trade Desk, reflecting a disciplined approach to risk as conditions evolve.

The Edinburgh‑based team oversees a globally oriented, all‑listed portfolio. All holdings are listed companies, unlike Baillie Gifford US Growth, the sister investment trust, which has a substantial allocation to unquoted holdings. Management charges are competitive at about 0.52 percent annually. The fund’s structure supports regular cross‑Atlantic visits to the companies it owns—an approach Gibson says helps the team understand business models, leadership cultures and strategic alignments in a way that data alone cannot. 'Being based in a city like Edinburgh gives us space and time to think and not get swept up in the excitement that can swirl around high‑growth stocks,' she says.

The fund’s track record still attracts attention even as markets fluctuate. While the 10‑year run highlights spectacular growth opportunities seized in U.S. tech, the near‑term results reflect the sensitivity of growth stocks to higher rates and inflation dynamics. Gibson emphasizes that the fund’s objective remains to identify long‑term opportunities, with a focus on durable franchises, founder influence and defensible business moats. Investors are urged to keep a multi‑year horizon in mind and to assess the fund alongside its history of volatility and resilience.

The fund’s performance narrative also mirrors a broader market pattern: periods of stellar long‑term gains can be punctuated by pullbacks, especially when rates rise or headlines shift macro expectations. For Baillie Gifford American, the inclusion of high‑quality, founder‑led growth names can deliver outsized upside over time, even as shorter‑term hurdles appear. The managers’ emphasis on direct access to CEOs and their view of corporate culture as a driver of value creation remains a distinctive feature of the strategy. As Gibson puts it, the combination of founder leadership, a long‑term framework and a hands‑on approach to staying connected with the companies helps the fund navigate inevitable cycles in technology and growth.

In sum, Baillie Gifford American represents a disciplined, long‑term vehicle for investors seeking exposure to U.S. technology and growth leaders who can sustain competitive advantages over time. While the path to returns can be bumpy, the fund’s founder‑led tilt, active engagement with portfolio companies and global research footprint remain core elements of its investment philosophy.