Blackstone bets £100 billion on UK property as Haven parks gear up for staycation surge

Private equity group aims to broaden Haven’s reinvention and expand its UK footprint, tying investment to a broader staycation rebound and regional regeneration

Blackstone plans to invest £100 billion in UK property over the next decade, a large bet on a staycation-driven rebound as the private equity group expands its footprint in consumer-facing assets such as Haven holiday parks, along with data centres, logistics and railway arches. The plan, which Blackstone describes as Britain’s largest overseas investment drive, follows the 2021 acquisition of Haven’s 39 holiday parks from founding families as part of a £3 billion deal that also included Warner Hotels.

Haven has been undergoing a brand refit under chief executive Simon Palethorpe, a former president of Carnival UK’s cruises unit, as Blackstone seeks to shed the tired image of the static caravan stay. Palethorpe says the business is expanding into higher-end experiences while keeping an affordable entry point — a basic break starting at £49 — and niche offerings such as New England clapboard “lodge” style caravans where a four-night Christmas stay for four can run to about £800. The company is highlighting updated facilities, a stronger on-site staff presence and a broader entertainment slate, including pantomimes produced by in-house teams. Palethorpe argues the focus on comfort, cleanliness and service matters just as much as price in winning staycationers.

Blackstone contends the expansion is about more than holiday parks. Its UK portfolio already spans data centres, logistics hubs and even railway arches, and the group plans to invest in Haven’s estate across England, Scotland and Wales as part of broader UK projects. Since 2021, Haven has been repositioned with an emphasis on long-term freeholds and asset-light operations that Palethorpe says protect staff livelihoods while enabling growth across the network. The plan includes a water park investment in Kent — an £11 million project slated to open in spring — and ongoing expansion across other sites in Blackpool, Norfolk, the Lake District, Wales and Scotland. Blackstone raised about £2.9 billion in finance for Haven earlier this year, funds the company says will underpin the next wave of upgrades and site expansions.

The strategy aligns with a broader push to regenerate coastal towns and rural economies where Haven parks operate. The group employs about 50,000 people in Britain, with Haven accounting for more than 13,000 roles. Palethorpe emphasizes training and progression, saying staff can move up from entry-level roles to positions such as chefs, lifeguards or managers as the sites evolve. He also notes plans to grow hospitality offerings within the parks, including nine Wetherspoons outlets scheduled to open across Haven sites by next summer after a deal reached last year.

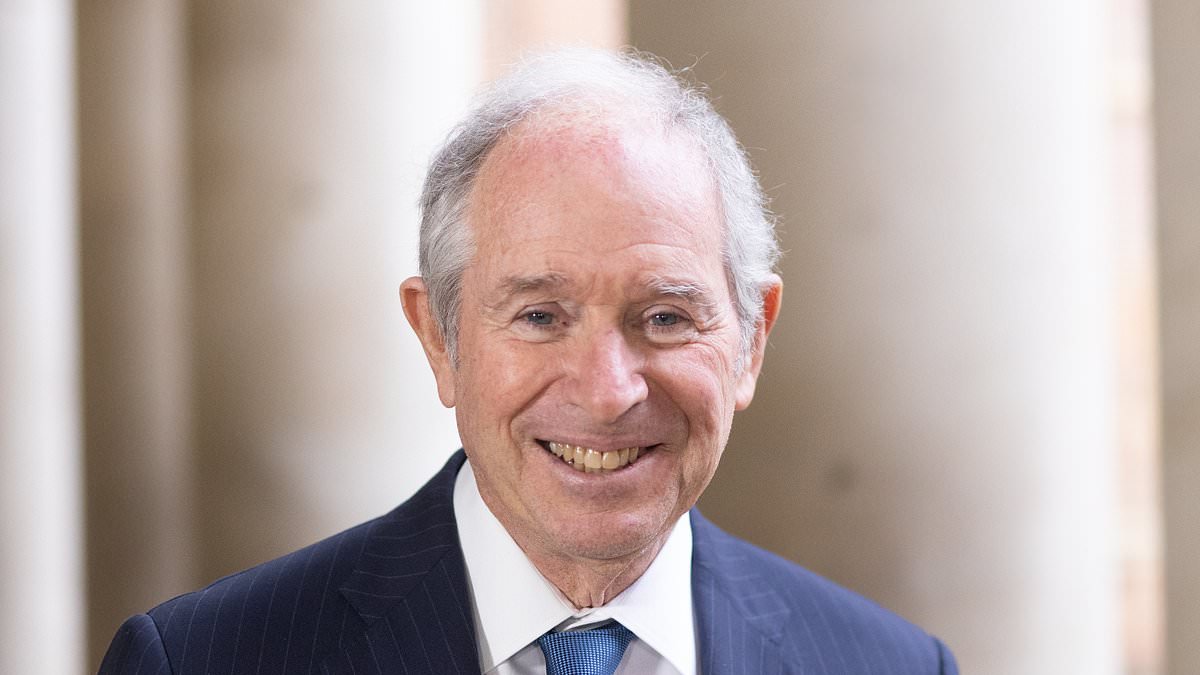

The commitments come as a political backdrop colors investment decisions. Chancellor Rachel Reeves has signaled a willingness to recalibrate tax and wage policies, including measures on the minimum wage and employers’ National Insurance Contributions that UKHospitality warned could threaten up to 100,000 hospitality jobs. Reeves herself visited a Haven park this summer with her children, prompting questions about how policy could influence the sector’s labour market and investment climate. Business leaders have pointed to Schwarzman’s influence in British affairs as a tacit factor shaping government discussions about investment in hospitality and regional development. Schwarzman, who has described Britain as a strategic priority and owns the Conholt Park estate in Wiltshire, has shown a willingness to engage on behalf of his business interests, including ties to the hospitality and real estate sectors.

Blackstone’spublicized UK ambitions were unveiled amid high-profile attention during President Trump’s state visit in September, underscoring the scale of the group’s long-term bet on Britain’s property and tourism mix. In Palethorpe’s telling, the focus is not simply on capital expenditure but on a sustainable model that blends job creation with improved guest experiences in places often far from urban centres. The improvement and expansion plan includes new small-town and coastal site upgrades as well as larger, more modern facilities at flagship parks, with a view to boosting regional regeneration while delivering predictable returns for investors.

Analysts note the complexity of such a strategy, given wage pressures, inflation and the evolving competitive landscape in UK hospitality and property. Still, Blackstone frames Haven as a proving ground for a diversified UK portfolio that can withstand macro headwinds by targeting resilient consumer demand for affordable, family-friendly breaks. If successful, the approach could set a template for how private equity harnesses branding, asset upgrades and workforce development to drive value in regional markets. The scale of the investment also positions Haven as a significant employer and a reputational anchor for Blackstone’s broader UK ambitions, while reinforcing Britain’s status as a magnet for foreign capital in a post-Brexit economy.

IMAGE 4 PLACEHOLDER

These plans come with the caveat that policy changes or shifts in consumer behavior could influence outcomes. Still, Blackstone’s bet on Haven — and on a broader suite of UK real estate and hospitality assets — signals confidence in a long runway for regional regeneration and for the staycation economy as a core driver of the market in the coming decade. The next several years will test whether such a high-conviction strategy can translate into durable growth for Britain’s towns and coastlines, while delivering returns for one of the world’s largest investment firms.