CC Japan Income & Growth Trust marks tenth birthday with dividend-led gains in Japan

Dividend-focused strategy has delivered about 190% total returns since 2015, outperforming the TOPIX over the period

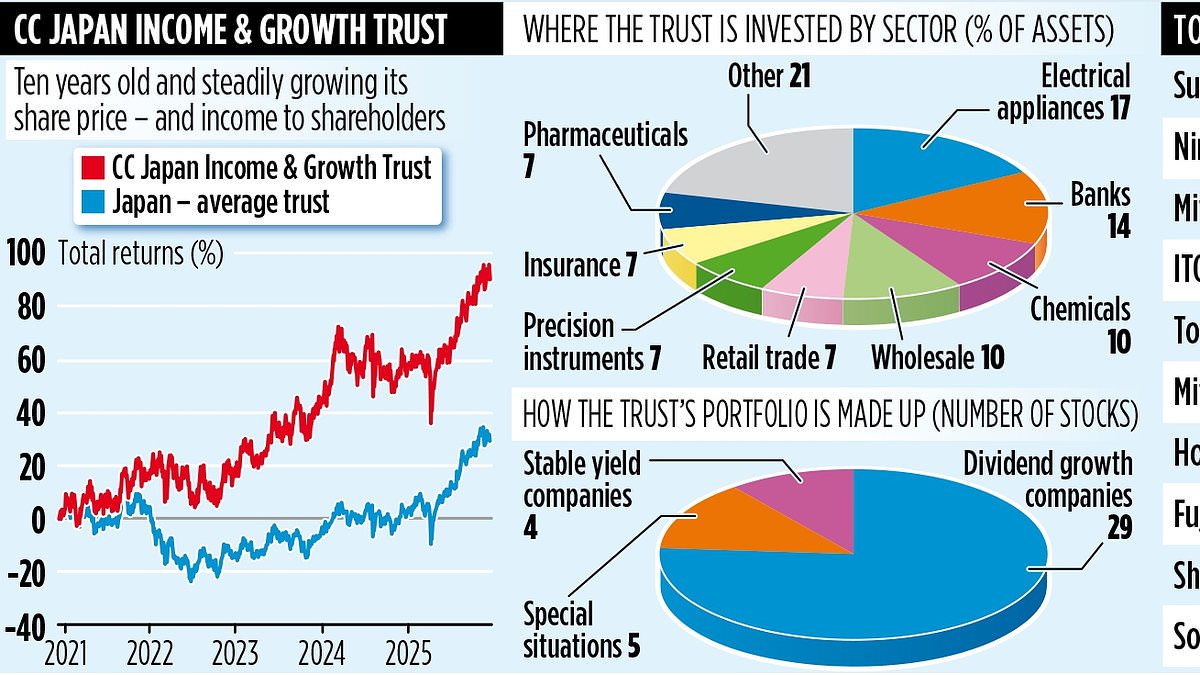

The CC Japan Income & Growth Trust celebrated its 10th anniversary at the London Stock Exchange last week, underscoring a decade of performance from a fund focused on dividend-friendly Japanese equities. Since its 2015 launch, the trust has delivered total returns of about 190% to its initial shareholders, compared with roughly 150% for the Tokyo Stock Price Index, or TOPIX, over the same period. The milestone highlights a growing investor interest in Japan as a source of income and potential capital appreciation, underpinned by reforms aimed at boosting corporate governance and shareholder payouts.

Richard Aston, who has managed the trust since its launch after eight years in Tokyo as part of JPMorgan Asset Management’s Japanese equities team, oversaw the celebrations and the afternoon close at the LSE. "When I rocked up in Tokyo in 2003, Japan was very much a travel destination," he said. "But today, while still a fantastic place to visit, it has become an investment destination for many international investors. The argument for investing in Japan is stronger than ever." He attributed much of the turn in sentiment to governance reforms that have encouraged shareholder-friendly behavior and an increasing tendency among Japanese companies to pay regular, rising dividends.

The trust’s portfolio is built around this dividend-growth premise. It has around £298 million in assets and is on track to notch up its ninth year of annual dividend growth early next year, when it announces the final six-month dividend for the year ending March 31. Last year’s income distribution was 5.45p per share, with the shares trading near £2.22. Aston describes the proposition as simple: "We look for companies that will deliver us an attractive total return, comprising a mix of capital appreciation and dividend growth." The portfolio remains selective: about 400 companies are on the radar, but only roughly a quarter pass the screen, and 38 end up in the portfolio. The vast majority are dividend growers; among the mainstays are Mitsubishi Corporation and Sumitomo Mitsui Financial Group, held since launch and since 2016 respectively, albeit with occasional profits realized.

Nissan Chemical serves as an example of the occasional, purposefully selective inclusion. Aston notes that the company has multiple arms—chemical production, animal health products and coating materials for LCD units—and that these businesses have required substantial investment, reducing cash available for dividend payments in the near term. He says that once these high-margin lines contribute more robust cash flows again, Nissan Chemical could be put back on a steadier dividend footing. The manager emphasizes that the portfolio also includes a small number of stocks where near-term visibility is cloudier but long-term dividend growth remains attractive, a balance the team seeks to manage over time.

Beyond stock selection, Aston points to broader macro tailwinds for Japanese equities. The return of inflation after years of deflation has allowed many companies to raise prices, improve cash flow and lift margins. He also believes Japan sits in a geopolitical sweet spot, benefiting from strong ties with China, India and the United States. The fund is structured to capture such dynamics while maintaining a disciplined, income-oriented approach.

The trust trades on the London Stock Exchange under the ticker CCJI and uses the identification code BYSRMH1. Annual charges total 1.03%. The fund’s performance and strategy reflect a deliberate, long-term view toward dividend growth alongside price appreciation, anchored by a domestically evolving corporate governance framework and a more confident domestic market context. Investors considering exposure to Japan through a focused, income-oriented vehicle may find CC Japan Income & Growth to offer a differentiated proposition relative to broader market trackers, with a history of regular dividend growth and a track record of outpacing the benchmark TOPIX on total return over the past several years.