Fresh US tariffs rock AstraZeneca and GSK

Tariffs on branded drugs spark uncertainty for UK pharmaceutical giants as ministers press Washington for favorable terms in ongoing talks.

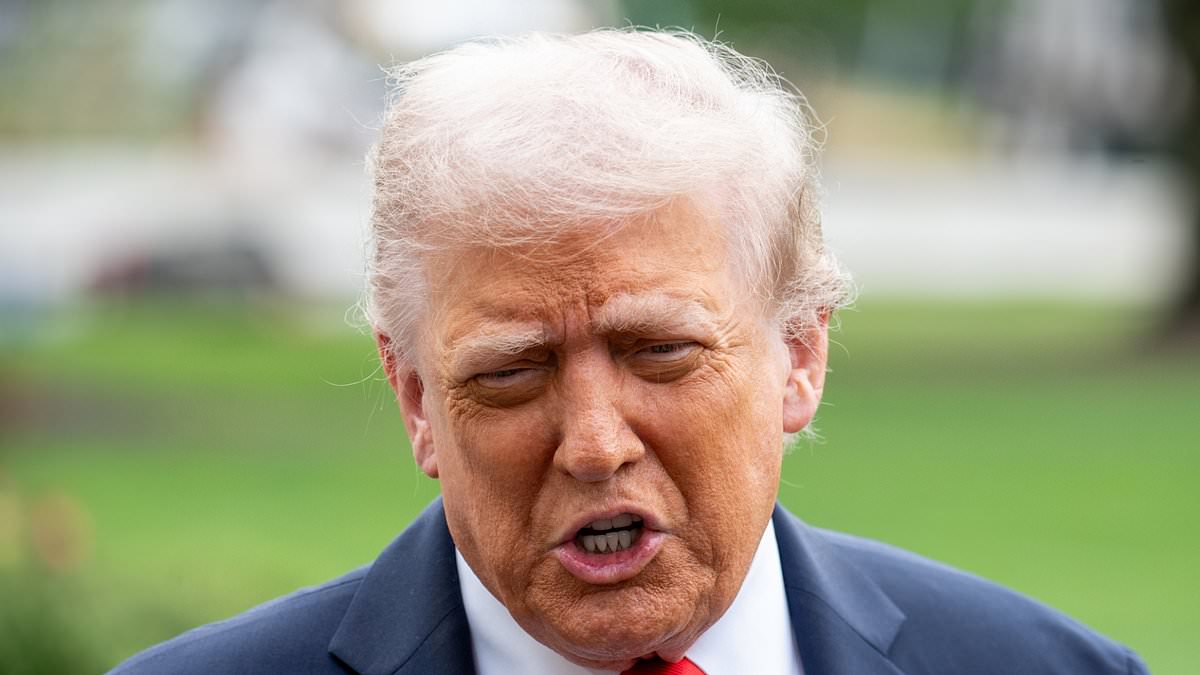

President Donald Trump announced a 100% tariff on imports of branded pharmaceutical products that would take effect next Wednesday unless the companies involved build manufacturing sites in the United States. The move targets AstraZeneca and GlaxoSmithKline, two of Britain's largest drugmakers, and immediately raises questions about how it would affect profitability, investment plans and jobs tied to the U.S. market. Industry observers described the measure as a dramatic lever aimed at reshaping where branded medicines are produced and sold, with the potential to disrupt supply chains that span multiple continents.

The tariff applies to new branded medicines and would require firms to establish U.S. manufacturing if they want to avoid the levy. The surprise move follows months of tariff rhetoric and comes as London and Washington seek to smooth cooperation on pharmaceuticals, a sector central to both economies. A UK government spokesman said sectors such as pharmaceuticals are critical to the economy and that ministers would continue to press the United States for outcomes that reflect the strength of the bilateral relationship and deliver real benefits for UK industry. The government noted it would monitor the policy’s impact on investment and jobs and seek clarifications where possible.

In May, Britain and the United States said they intended to negotiate significantly preferential treatment outcomes on pharmaceuticals. It remained unclear whether the UK would be protected by that framework, and observers cautioned that the terms could hinge on later negotiations. Across the European Union, Ireland’s trade minister said any new tariffs would be capped at about 15% because of Ireland’s agreement with the United States, but Britain’s deal with the United States imposes a baseline 10% tariff and its shielding of the UK remains uncertain. The lack of clarity adds to the risk for drugmakers with extensive U.S. operations.

GSK and AstraZeneca have deep ties to the U.S. market. GSK employs about 15,000 people in the United States across five manufacturing sites and has announced plans to invest roughly £22 billion in the United States over the next five years. AstraZeneca, too, employs more than 18,000 people in the United States and has been shifting more production there, tightening links between their U.S. plants and global supply chains. The tariff announcement prompted early stock reactions, with shares in both companies dipping in morning trading before partially recovering as traders weighed the potential impact against the possibility of carve-outs or exemptions.

The British Chambers of Commerce called the tariff move a sign of fresh uncertainty for the industry, underscoring how a policy shift in the United States could reverberate through UK corporate earnings, capital expenditure plans and employment in the sector. Analysts noted that any exemptions, phased implementations or transitional periods could meaningfully alter the actual effect on cash flow and profitability.

Industry observers say the policy could push UK firms to reassess how much of their branded portfolio is tied to U.S. manufacturing and whether to accelerate onshoring or diversification. The sector, already navigating pricing pressures and regulatory hurdles, could see a reordering of investment decisions if the tariffs prove durable or if Washington broadens the policy to include additional products or categories. In the near term, the market focus is likely to remain on the details—exact product scope, transition timelines, and any exemptions—that determine how painful the levy will be for individual drug programs and corporate earnings.

Meanwhile, government spokesmen and business groups emphasize the long arc of the U.S.–UK relationship. UK ministers say the partnership in pharmaceuticals remains a strategic priority, and they plan to press the United States to secure terms that reflect the value of a deep, cross-border healthcare ecosystem. Analysts caution that even with diplomacy, the immediate effect on investors and global supply chains will be felt as companies reassess inventories, manufacturing footprints and timelines for drug launches in the United States.

As the timeline unfolds, AstraZeneca and GSK, along with other multinational drugmakers, will watch for any shifts in the tariff regime, potential bilateral exemptions, and the broader trajectory of U.S. industrial policy toward pharmaceuticals. The outcome will hinge on ongoing talks, clarifications from policymakers, and the industry’s ability to adapt its production footprints in a way that preserves access to patients while protecting corporate competitiveness in a volatile policy environment.