From $6 Billion to foreclosure: Gary Winnick's rise and fall in Los Angeles

Los Angeles’ once-richest financier watched a fortune built on telecom and real estate unravel under mounting debt, culminating in foreclosure battles over Casa Encantada years after his death.

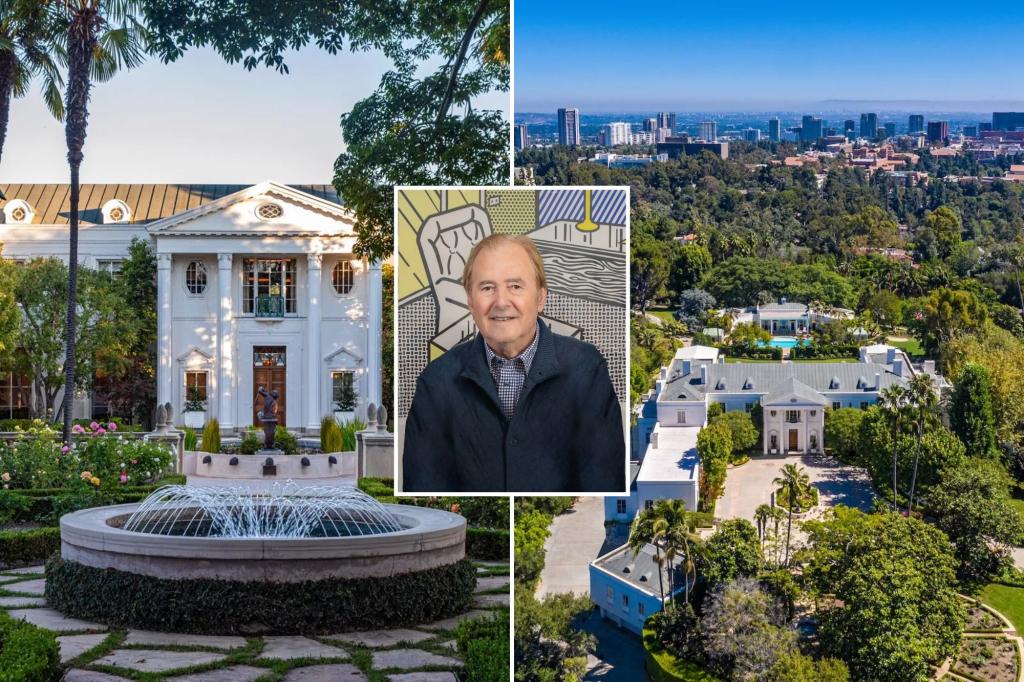

Gary Winnick, once Los Angeles’ wealthiest financier with a peak net worth estimated at $6.2 billion, died on Nov. 3, 2023, at age 76. In life and in legacy, his fortune unraveled as debt mounted and lawsuits multiplied, leaving his widow to confront foreclosure threats tied to Casa Encantada, the Bel Air estate that anchored a vast, high-cost portfolio.

During the 1990s, Winnick built Global Crossing into a telecom powerhouse by financing a sprawling transcontinental network with heavy borrowing. The boom years coincided with a display of wealth that included a real estate and art collection befitting a marquee Los Angeles figure. In 2000, Winnick and his wife, Karen, bought Casa Encantada for $94 million — at the time the most expensive U.S. home sale — and poured tens of millions more into renovations, restoring the 40,000-square-foot estate to museum‑worthy condition. The couple also expanded their holdings with a Malibu beach house, a Sherry-Netherland pied-à-terre in New York, and a collection featuring works by Cy Twombly and Edward Hopper. Winnick was a longtime donor and board member at cultural institutions, including the Museum of Modern Art, and hosted fundraisers at Casa Encantada.

The dot-com era and the telecom bubble burst soon after. In March 2000, Global Crossing’s ambitious expansion ran into reality as startups it served ran out of cash; revenues fell short of projections, and debt ballooned into the billions. In January 2002, Global Crossing filed for Chapter 11 bankruptcy, wiping out tens of billions in market value and triggering investigations, lawsuits, and deep investor losses. Winnick had already cashed out roughly $730 million in stock before the collapse, and in 2004 he personally paid $55 million to settle shareholder lawsuits. He was never criminally charged.

Even as the company faltered, Winnick maintained the high‑end lifestyle that had defined his orbit in business and philanthropy. He pursued other ventures across media and technology and remained a familiar figure in elite clubs and philanthropic circles. The financial unraveling that began in the early 2000s stretched into a long legal and debt tail that followed him into the 2020s. A revolving loan from CIM, initially extended to him personally, grew into a lien on assets that included Casa Encantada, increasing pressure to monetize the estate.

By 2023, estimates of the family’s debt climbed to roughly $155 million, and the estate pursued a sale of Casa Encantada for $250 million — the highest asking price in the country at the time. The sale did not close. Winnick died two weeks before a deposition in a lawsuit tied to a failed investment, and only afterward did his widow say she learned the full scope of the family’s financial exposure, including that homes, art and even a wedding ring had been pledged as collateral.

The estate’s fortunes deteriorated further in the following two years. By late 2025, Casa Encantada faced foreclosure as the estate proved insolvent, with a court stay briefly halting an auction that would have marked the property’s transfer from the Winnick family. The saga of Winnick’s wealth — from a towering peak during the height of Wall Street excess to a foreclosure fight over a storied Bel Air estate — underscores the lasting risks of aggressive leverage and the capriciousness of fortunes tied to real estate and speculative ventures in the technology era.