Holiday-season scams surge as shoppers report losses across New York and beyond

Officials warn of too-good-to-be-true deals, fake websites and deceptive delivery notices that threaten holiday finances

NEW YORK — The festive season has become boom time for scammers, with residents across the city and state reporting a rise in fraud tied to online shopping, phony travel offers and fake delivery notices. The pattern emerged just as millions hunt for gifts and travel deals, and several New Yorkers say they were left out of pocket after trusting too-good-to-be-true offers or questionable third-party sellers.

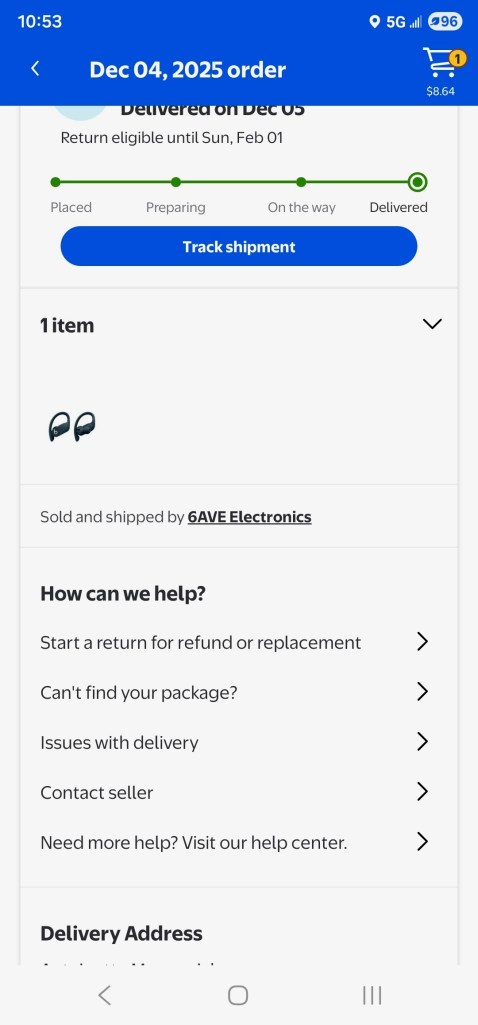

Toni Campbell, a 63-year-old administrative assistant from Queens, learned the hard way on Dec. 5 that the season’s cheer can be a trap. She was expecting a $200 pair of Beats by Dre Powerbeats Pro earbuds purchased from a third-party seller on Walmart.com for her teenage nephew. Instead, the FedEx package she opened at work contained 500 sheets of blank printing paper. “I was, like, ‘Wait! My stuff isn’t in here,’” Campbell recalled to The Post. “I showed my coworker, and she said, ‘Oh my God, they scammed you!’” The episode prompted a sprint to the office bathroom and back, illustrating how the anxiety of holiday shopping can become physical stress when a delivery goes wrong or a purchase never arrives. Campbell says she remains out more than $200 and has not received a refund from either Walmart or the seller, 6AVE Electronics. Walmart said the customer has been in contact with both customer care and the third-party seller to resolve the issue. FedEx said it is working directly with the customer to resolve the matter.

The episode is part of a broader, seasonal pattern in which fraudsters target holiday shoppers with a mix of fake storefronts, deceptive delivery notices, and suspicious travel bargains. Darius Kingsley, head of consumer fraud and scam prevention at JPMorganChase, said “Scammers are especially active during the holidays, using tactics like fraudulent travel offers, fake delivery notifications, and deceptive charity appeals to exploit the holiday season and people’s generosity.” He urged consumers to beware of offers that seem too good to be true, noting that the best defense is skepticism and verification.

The scale of the problem extends beyond a single city. New York, as a whole, recorded an average of 140 quarterly fraud reports per 100,000 residents over the past three years, according to an analysis based on data from the Federal Trade Commission. Since 2021, the Empire State has logged 336,894 fraud claims, with victims losing a median of $553.77 per report — roughly 6% higher than the national average loss of $522.55 per report. Campbell’s case reflects a common pattern: a seemingly legitimate purchase that turns into a financial sting. The state’s numbers show that holiday scammers are not only numerous but often costly for individual victims.

Beyond New York, stories from other states underscore the nationwide reach of these schemes. Vanessa Tingey, 28, of near Orlando, Florida, described an online shopping trap in which a fake site offered Owala water bottles at deep discounts. After entering her payment information, Tingey did not receive an order confirmation, and she later received Chase Bank alerts for a fraudulent $500 purchase to Sri Lanka Airlines. By the time Chase canceled the charge, Tingey’s budget was strained, and she warned others to be cautious about online deals that appear too good to be true.

In Texas, Rhonda Hadden, a single mother of three from San Antonio, said she was shocked when her Walmart account was accessed to purchase two $150 gift cards, totalling about $313, using her debit card. She said a store call center did not escalate the issue, and she was advised to file a police report and contact her bank to dispute the charges. Walmart told The Post that customers should report unauthorized transactions to their banks and update passwords on any online accounts where payment information is stored, adding that protections often apply only when transactions occur on the platform where the purchase was made. Hadden estimated the loss at more than $300 and said the timing was especially painful as she tries to manage family expenses during the holidays.

Another high-profile case involved Star Friisval from Wisconsin, who said a Trip.com purchase for a round-trip flight for two adults and two children totaled about $1,097 on a site she believed to be legitimate. After she completed the booking, she was immediately told the flight had been canceled, and she spent hours on the phone with customer service trying to secure a refund. She had received only a partial refund of $140.17 to date and said the elapsed time before Christmas meant no time to replace gifts or arrangements. Friisval urged other travelers to verify sites directly and prefer booking flights through official airline sites or recognized travel portals.

Kingsley emphasized practical steps to reduce risk during the holiday rush. He advised sticking to reputable websites and performing a quick web search for complaints or warnings about unfamiliar stores. When shopping on social platforms or marketplaces, buyers should stay on the platform to complete transactions, because protections are often tied to those channels. He recommended checking that URLs begin with https://, avoiding links from unsolicited emails or texts, and recognizing that deals that seem unrealistically cheap are often a red flag. For payment safety, he suggested using credit cards or debit cards that permit easy chargebacks, and cautioned against paying others via services like Zelle unless the recipient is someone you know and trust. He also pointed to digital tools, such as Chase Credit Journey, for monitoring credit and identity alerts—services that can help detect breaches or misuse of financial information even for non-Chase customers.

The investigation highlights a mix of responses from retailers and shipping firms. Walmart said it supports customers who report unauthorized purchases and that the company advises customers to contact the bank and the online platform for protection. FedEx said it is working directly with the customer to resolve the issue, but a spokesperson did not provide details on outcomes. The third-party seller involved in Campbell’s case did not respond to requests for comment, and Walmart noted that it is working with the customer and the seller toward a resolution. Some victims noted that the refunds or replacements came slowly or not at all, underscoring the frustration and financial strain of holiday scams.

The landscape for online shopping and travel during the holidays remains crowded with legitimate sales and promotions, but the volume and variety of scams persist. The FTC-based analysis shows that fraud is not a niche risk tied to a single medium or region; instead, it is a systemic risk that touches e-commerce platforms, payment networks, and even traditional retailers acting as marketplaces. Shoppers are urged to exercise heightened scrutiny, particularly when discounts appear unusually steep or when orders originate from third-party vendors that are not well known. The season’s financial toll is not limited to the moment of purchase; it can ripple through families and budgets well into the new year as victims manage disputes, chargebacks and lost gifts.

As the holidays continue and people finalize gift plans, authorities and financial institutions continue to encourage vigilance and verification. The data remind consumers that, in the realm of holiday shopping, a skeptical eye can be the best gift of all. In the meantime, retailers and couriers reiterate their willingness to work with customers and law enforcement as they pursue redress and protect others from similar schemes.