Massachusetts orders DraftKings to pay $934K after botched MLB parlay bets

Regulators reject DraftKings' bid to void nearly $1 million in payouts tied to a misclassified MLB market; operator internal configuration error cited

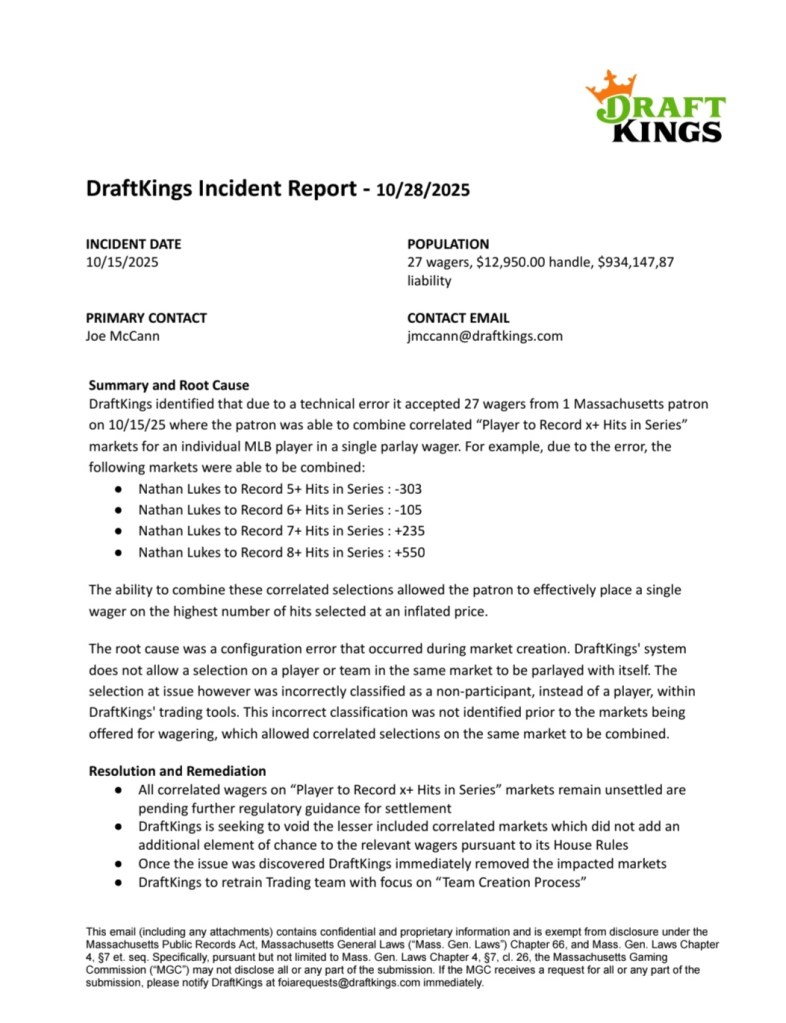

Massachusetts regulators on Thursday ordered DraftKings to pay about $934,137 in winnings tied to a botched MLB parlay scheme, ruling that the operator failed to uphold market integrity during the seven-game American League Championship Series between the Toronto Blue Jays and Seattle Mariners. The Massachusetts Gaming Commission voted 5-0 to reject DraftKings’ bid to void the payouts linked to a misconfigured market, a decision regulators described as rooted in an internal tool error rather than a third-party data failure.

A Massachusetts customer placed 27 multi-leg parlays tied to Nathan Lukes, a Blue Jays player, across the series. The bets were linked to DraftKings’ “Player to Record X+ Hits in Series” market. Because of a misclassification inside DraftKings’ trading tools, Lukes was labeled a non-participant rather than an active player, which disabled safeguards intended to prevent bettors from stacking correlated outcomes from the same market. That flaw allowed the bettor to aggregate multiple hit-threshold outcomes — 5+, 6+, 7+, and 8+ hits — into single parlays, effectively creating inflated wagers on Lukes recording eight or more hits at dramatically enhanced odds. The bettor’s activity spanned 27 multi-leg parlays, of which 24 hit, while three failed due to unrelated college football legs involving Clemson, Florida State and Miami. Lukes ultimately appeared in all seven games and finished the series with nine hits, meeting every threshold sold in the wagers.

The commission’s decision contrasted with DraftKings’ position that the bets should never have been accepted and that the patron acted unethically by exploiting an obvious error. During the hearing, Commissioner Eileen O’Brien criticized the operator for casting the bettor as fraudulent and said the situation did not meet the standard of an “obvious error.” She added that the root cause lay with DraftKings’ internal configuration failures, not with the bettor’s conduct, and urged regulators to consider the consumer’s perspective. “An obvious error is a legal and factual impossibility,” O’Brien said, but she stressed that DraftKings’ responsibility to ensure market integrity outweighed arguments about bettor ethics. Other commissioners echoed the view that operators must maintain the integrity of their markets and that the onus is on the operator to prevent such errors. DraftKings acknowledged the root cause was internal, not tied to a third-party odds provider or data feed, and said it had pulled the affected markets, left unsettled wagers in limbo pending regulatory guidance, and implemented corrective fixes. The company stressed that no other Massachusetts customers were affected, though regulators noted the same issue had appeared in two other jurisdictions.

The commission’s ruling emphasizes that, in regulated online betting, operators bear primary responsibility for the structure and safeguards of their markets and that internal misconfigurations can lead to unintended, financially material outcomes. Regulators and industry observers say the decision could influence future proceedings when sportsbooks encounter system errors and raises questions about how swiftly operators should compensate players when error-driven bets produce large winnings. DraftKings has not provided a further public comment beyond the hearing and its immediate regulatory filings.

In illustrating the broader stakes, the Massachusetts ruling underscores the ongoing scrutiny of risk controls in regulated sports betting markets. Regulators in other states have pursued similar inquiries into how operators verify bets, manage correlated wagers, and respond to internal tool failures. The case highlights the tension between preserving market integrity and honoring customer expectations in a rapidly expanding industry that continues to adapt to new wagering configurations and data-management challenges. The Post reported the decision and described the hearing as part of ongoing scrutiny of operator risk controls in regulated markets, noting that Massachusetts’ action could influence how other jurisdictions handle similar incidents in the future.