Mobile operator Three refunds £1,450 after 15-year billing error

Reader recovers funds after unauthorised debits from Three (now Vodafone Three) spanned 15 years; class-action against several carriers remains under way.

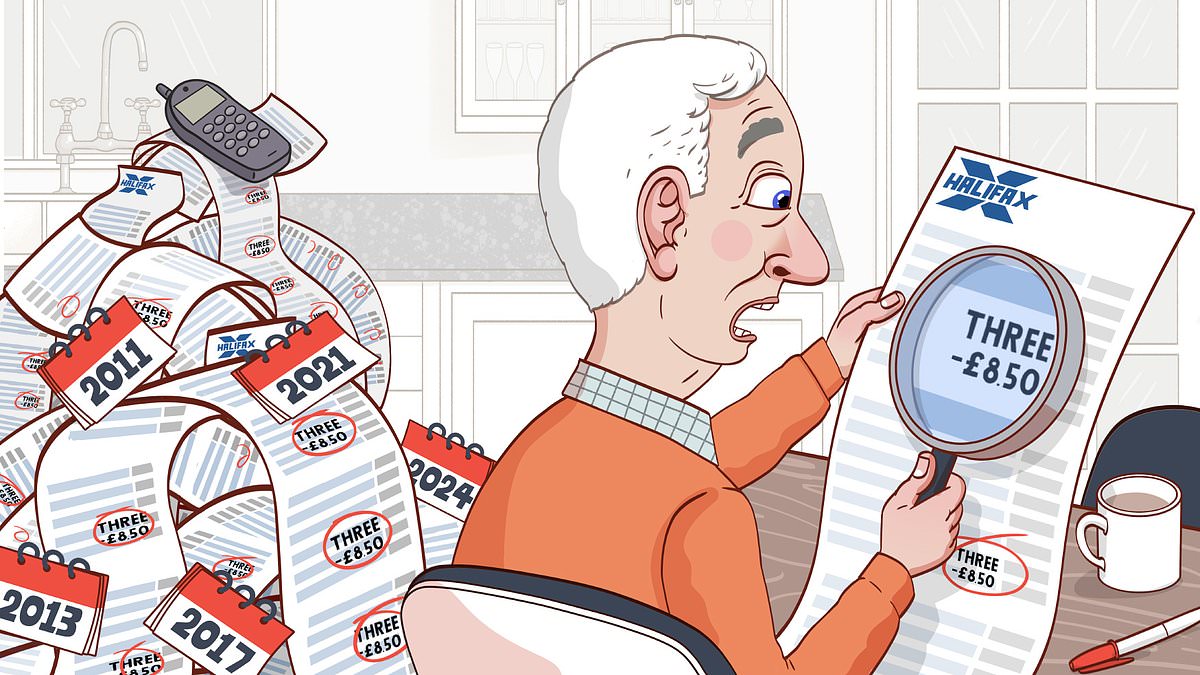

London — A reader has recovered about £1,450 after discovering that mobile operator Three, now Vodafone Three, was deducting unauthorised payments from a Halifax bank account for roughly 15 years after a dongle contract ended in 2010. The monthly charges began four months after the contract ended, starting with small sums and gradually continuing for more than a decade, long after any usage had ceased. The reader first noticed an £8.50 payment that appeared on bank statements, then traced earlier charges that had continued despite the supposed cancellation of the service. The payments were taken even though the account showed no activity, and the user says the company never provided a convincing explanation for why the debits continued.

Three told the reader the account had been inactive since 2010 and showed no usage, but a customer-service representative directed them to loyaltypenaltyclaim.com, the site linked to a class-action lawsuit accusing several mobile operators of penalising customers who remain loyal after contracts end. The action targets Vodafone, Three (now merged with Vodafone to form Vodafone Three), O2 and EE and contends that the operators overcharged millions by continuing to bill for handsets after initial contracts ended instead of charging only for usage. The case is set to go to court, though no date has been announced. If successful, eligible customers who held contracts between October 2015 and March 2025 could receive an average payout of about £104. Participants do not need to sign up to the class action to be included, though they can opt out if they choose.

The reader had not been a continuing customer once the payments were identified. After repeated refusals to refund the sums, Three offered £100 in late September, an offer described as derisory by the reader and rejected. The claimant then pursued a direct debit indemnity claim with Halifax. The indirect process works similarly to a chargeback: the bank refunds the customer first and then asks the company to contest the claim. There is no time limit for making a direct debit indemnity claim, and the bank typically refunds within ten days if the merchant is deemed to have acted improperly. In this case, Halifax refunded the money and subsequently recouped the identical sum from Vodafone Three. Halifax also reimbursed £200 in overdraft charges that the reader argued would not have occurred if the funds had not been taken, and the bank paid a £40 apology for not acting sooner. Vodafone Three acknowledged that the customer should not have been directed to loyaltypenaltyclaim.com and said the matter was being investigated by customer services.

Ultimately, the customer was told that the 15 years of erroneous debits would be reversed. The refund was arranged through the direct debit guarantee, with Halifax initially crediting the account and then reclaiming the funds from Vodafone Three. The customer notes that the total amount returned to date — roughly £1,450 — has provided some relief ahead of the Christmas season, though it does not fully compensate for the losses incurred. Vodafone Three issued a statement saying it was sorry for the inconvenience and that the refund had been completed. The company also stressed that the referral to loyaltypenaltyclaim.com should not have occurred and that the incident was being reviewed by its customer-services team. In addition to the refunded debits, the reader also received the overdraft charge reimbursement from Halifax, bringing the overall relief to about £1,450 in bank credit plus the smaller overdraft reimbursement.

The episode underscores the importance of vigilance over bank statements and the potential remedies available when unauthorised or unexpected charges appear. It also highlights the ongoing tension between class-action campaigns and individual refunds in the telecommunications sector. The class action remains without a court date, and the outcome could affect millions of customers who held mobile handset contracts with major carriers during the relevant window. While the current case does not guarantee a payout for every affected consumer, the potential average recovery cited by the plaintiffs has drawn attention to the broader issue of post-contract charges and “loyalty penalties.”

For readers who encounter similar issues, the guidance remains to act promptly: review bank statements regularly, notify the bank of any unrecognised charges, and pursue remedies through the bank’s indemnity or chargeback processes if applicable. If a provider dispute arises, keep a written record of all communications and requested documentation, and consider seeking independent advice if the provider’s response appears unsatisfactory. While the resolution in this case was specific to one reader and the partnership between Halifax and Vodafone Three, the broader story reflects a market-wide concern about how ongoing fees are billed after contracts lapse and what recourse consumers have when errors occur.