Retail sales fall as Black Friday deals fail to lure shoppers

ONS data show November volumes slipped 0.1% as discounting underwhelmed and shoppers remained cautious ahead of Christmas; borrowing data also underscored fiscal pressures.

The UK’s retail market contracted in November as Black Friday discounts failed to lift spending, official data show, with sales volumes dipping 0.1% from October and undershooting forecasts for a 0.4% rise. The marginal retreat came as supermarket sales fell for the fourth month in a row, and discounts across November did not lift Black Friday spending as much as in recent years. The figures from the Office for National Statistics highlight a fragile consumer backdrop even as some categories—such as computers, clothing and furniture—have posted gains in recent months.

Alongside the headline retail figure, the ONS noted that while the month was weak overall, certain segments showed resilience over recent months. Purchases of computers, clothing and furniture helped lift the broader picture in the months leading into the festive period, though retailers will be watching closely for December momentum as supply chains and costs continue to influence pricing decisions.

Separately, a GfK consumer confidence survey released on Friday suggested shoppers were willing to spend in the lead-up to Christmas, with December sentiment reaching a 16-month high. The survey found 31% of adults planned to take advantage of Black Friday deals, but 19% said they intended to buy less than last year. The picture of cautious but not extinguished demand aligns with comments from economists and retailers about a year-end lull in some discretionary categories.

Oliver Vernon-Harcourt, head of retail at Deloitte, said the cut in interest rates to 3.75% on Thursday could bolster shoppers’ confidence and help retailers spur a rebound in pre-Christmas spending. He noted that the rate cut, combined with easing price pressures in some belts of the economy, could support a late-season pickup for stores and online platforms alike.

The Bank of England’s latest survey of businesses said households remained “keenly focused” on value for money, with firms reporting that the Budget and related fiscal announcements had discouraged spending in recent months. AJ Bell’s Danni Hewson linked the mood to ongoing budget speculation, saying it had unnerved consumers at the peak of the festive shopping period and contributed to a cautious stance despite Black Friday temptations. She added that shoppers were watching for tax and benefit signals as policymakers debated the year ahead.

Mark Neale, chief executive of outdoors retailer Mountain Warehouse, told the BBC that budget speculation had been unhelpful for the sector, even as his company posted record sales during the period. He cautioned that uncertainty around fiscal policy can dampen demand, particularly for discretionary items sold in outdoor and adventure gear categories.

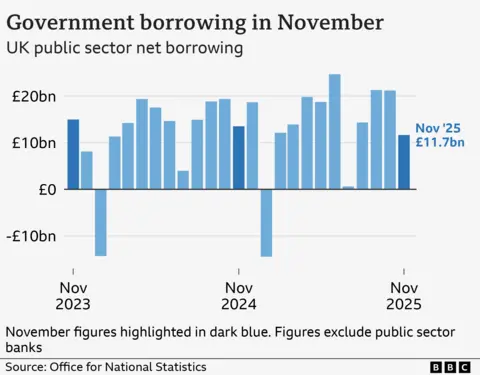

On the government’s finances, the ONS reported that November borrowing was £11.7 billion, above the £10 billion analysts had expected, though still the lowest November borrowing in four years. Year to date, borrowing stood at £132.3 billion, about £10 billion higher than the same point a year earlier. The improvement in the monthly deficit was attributed to higher receipts from taxes and National Insurance contributions, while part of the swing reflected policy choices such as reversing a decision to restrict winter fuel payments and granting inflation-linked pay rises in the public sector.

Chief Secretary to the Treasury James Murray said last month’s Budget would “deliver on our pledge to cut debt and borrowing,” while shadow chancellor Mel Stride accused the government of “piling up ever higher debt” through welfare and tax policy choices. Matt Swannell, chief economic adviser to the EY Item Club, warned that the government would need to deliver a significant slowdown in borrowing over the coming months if it is to meet the Office for Budget Responsibility’s target of about £138.3 billion for the current financial year.

As the Christmas shopping window advances, analysts say November’s soft print underlines the challenge for retailers to translate consumer caution into sustained demand. With inflation easing in some sectors and energy bills continuing to ease for many households, the coming weeks will be a crucial test of whether rate relief and fiscal policy can spur sustained gains in spending or whether the lull persists into the new year.