Trump unveils steep tariffs on drugs, furniture; prices may rise for Americans

Tariffs on pharmaceuticals, kitchen cabinets, bathroom vanities, upholstered furniture and heavy trucks could lift costs, while officials suggest delays or revisions are possible.

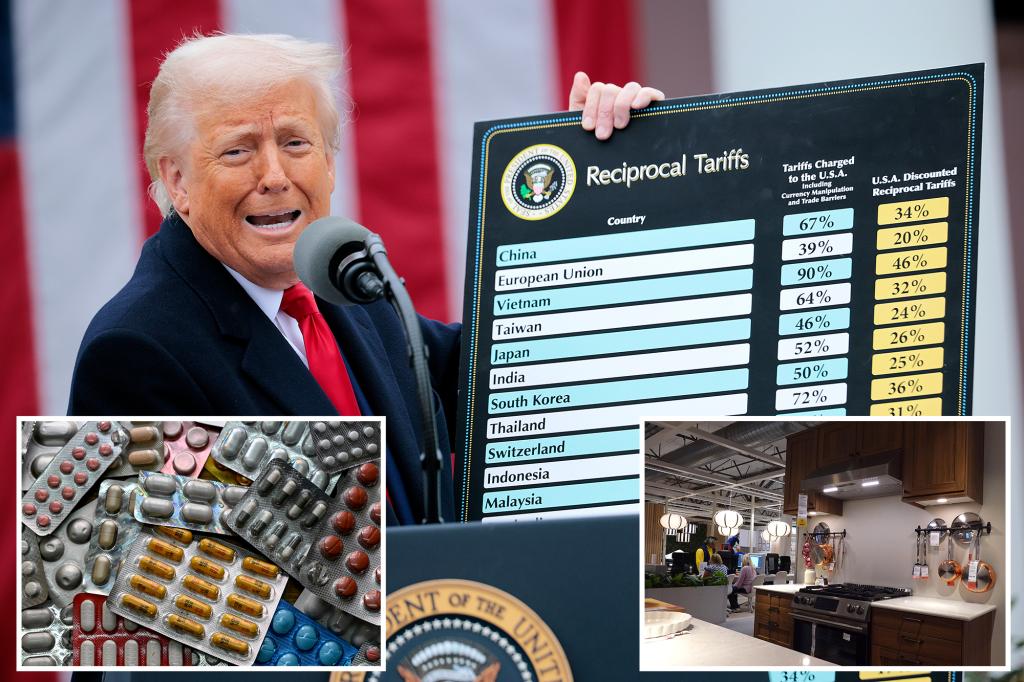

President Donald Trump unveiled a new package of tariffs on pharmaceutical drugs, upholstered furniture, kitchen cabinets, bathroom vanities and heavy trucks, with rates set to take effect on Oct. 1. The proposed levies would range from 25% to 100% and come as households already face higher living costs, economists said.

Under the plan, pharmaceutical drugs would face a 100% tariff, kitchen cabinets and bathroom vanities would be taxed at 50%, upholstered furniture at 30% and heavy trucks at 25%, according to the policy details circulated by trade observers. Consumers could see higher prices if the measures are enacted, though some analysts note that tariffs are often adjusted or delayed after initial announcements.

Pharmaceutical trade groups warned the plan could raise costs and possibly threaten access to medicines. PhRMA Senior Vice President Alex Schriver told The Post that tariffs on drugs could constrain investment in American manufacturing and in future treatments and cures. “Every dollar spent on tariffs is a dollar that cannot be invested in American manufacturing or the development of future treatments and cures,” Schriver said.

On the consumer side, the heavy burden would extend to home improvement as well as product safety and availability. A 50% tariff on kitchen cabinets and bathroom vanities could deter homeowners from remodeling projects, according to Wayne Winegarden, senior economics fellow at the Pacific Research Institute. He noted that housing affordability could worsen if people curb renovations because of higher costs.

The plan also targets upholstered furniture and heavy trucks, with a 30% tariff on the former and a 25% tariff on the latter. Imports accounted for about 42% of all upholstered furniture sold in the United States in 2020, a figure cited by trade researchers, underscoring how tariff changes could ripple through household purchases. Analysts added that the effect on prices would depend on company margins and supply chains; some firms might absorb the costs, while others could pass them along to consumers.

China remains the dominant source of furniture imports, with estimates showing it as the largest supplier at about $12.6 billion in 2024, followed by Vietnam at about $12 billion. For kitchen cabinets, about 57% of U.S. imports come from Southeast Asian countries, with another 10% from Mexico, according to U.S. Census Bureau data cited by the Coalition for a Prosperous America. China is also a major supplier of furniture and, as one industry executive noted, would be a focal point in any negotiations over tariff levels. “If [US officials] want something more out of China or feel like China is coming to the table in a really good way, I could completely see these tariffs being delayed, suspended, something like that,” Michael Goldman, general manager for North America at CARU Containers, told The Post.

Companies vary in how they would respond to the higher duties. A very efficient company with strong margins might be able to absorb some of the added costs, while a smaller business with a narrow product line—such as bathroom vanities—might be forced to raise prices or slow production, Goldman added. Delays on tariffs could also help consumers avoid higher prices for longer, as firms rush to import goods and stock up at the current, lower-rate environment.

Economists warn that tariffs of this size could influence inflation and growth at the same time, creating ambiguity for the Federal Reserve as it considers policy moves. Winegarden said the trade shocks could complicate inflation readings and slow economic expansion, potentially increasing the risk of a stagflation-like scenario. “Tariffs could be an impact on inflation, it could be an impact on growth, it could be an impact on both,” he said.

The timing and enforcement of any new tariffs remain uncertain. Observers note that a history of tariff adjustments and negotiations suggests prices may not rise uniformly across all products or countries, and some measures could be delayed or revised as talks continue with trading partners. Investors and consumers alike are watching closely as Oct. 1 approaches, bracing for possible shifts in costs, supply chains and pricing.