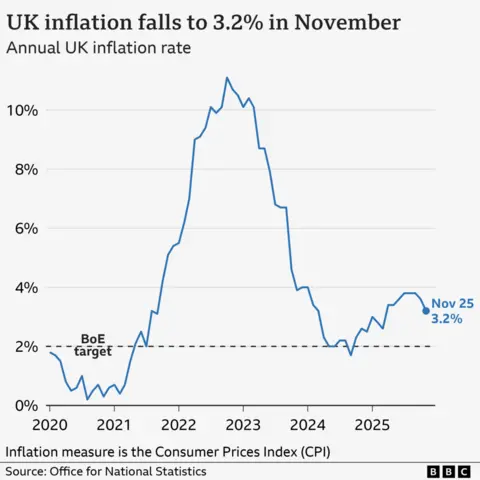

UK inflation slows to 3.2%, easing path for borrowing and rate cuts

Faster-than-expected cooling in food prices and slower overall price growth may push the Bank of England toward a policy rate cut, even as some items remain expensive for households.

Britain’s inflation rate cooled to 3.2% in the year to November, a sign that price growth is easing after a summer uptick but still well above the Bank of England’s 2% target. The year-over-year rise means a basket of goods and services that cost £100 a year ago would cost about £103.20 today, a reminder that while the pace of increases has slowed, households still face higher living costs than a year earlier.

Analysts say the slowdown is being driven in large part by easing food inflation, which remains the largest component of what households buy. Food and non-alcoholic drinks rose 4.2% in the year to November, compared with 4.9% in October. Alcohol and tobacco were up 4% versus 5.9% in October. The softer overall pace is, in part, the result of acute reductions in prices for staples such as olive oil, flour, pasta and sugar, even as other items like chocolate continue to run above year-ago levels. Chocolate is about 17% more expensive than a year ago. Beef and veal also remained costly, rising nearly 28% over 12 months.

Clothing and footwear also helped pull the index lower, with prices down 0.6% year over year in November, following a period of discounting as retailers sought to attract shoppers facing higher living costs. That price dynamic comes as households adjust spending choices and lean into lower-cost options and promotions.

The deceleration in inflation has broad implications for both borrowing and saving. Analysts say the softer price growth strengthens the case for a Bank of England Monetary Policy Committee rate cut at the central bank’s meeting this week, potentially making it cheaper to borrow. But for savers, the news is more mixed: lower inflation supports smaller erosion of spending power, yet it often translates into lower interest on cash deposits over time.

Lower inflation is good news for household budgets in the near term, but it also changes the calculus for savers and investors. Some savings returns have already been squeezed, and the path ahead will depend on how quickly price growth continues to cool and whether wage growth keeps pace. “Lower inflation is good news for household budgets, but it is a different story for savers,” said Sally Conway, a savings commentator at Shawbrook Bank. “Some savings will inevitably take a hit over Christmas. The key is what happens next. Once the dust settles, it’s worth checking whether remaining cash is working hard enough.”

Policy circles are also turning to broader reforms intended to help investors. The Financial Conduct Authority has given the go-ahead for targeted support that allows banks and financial firms to offer investment suggestions, a move aimed at encouraging households to consider stocks and shares as part of longer-term growth rather than relying on cash.

For households, the inflation mix matters unevenly. Food remains essential, and while broader price growth slows, the year-to-year rise in some staples continues to pinch those with tight budgets. The Bank of England’s outlook hinges not only on consumer prices but on wage trends, energy costs, and global supply conditions, which can re-accelerate price growth if shocks re-emerge.

Economists caution that while the November figure points to a cooling trend, it does not guarantee a sustained pullback in inflation. The path will depend on how quickly energy prices stabilize, how consumer demand responds to higher borrowing costs, and how businesses manage costs in a volatile international environment. The Bank of England is watching these dynamics closely ahead of its policy decision this week.

In the meantime, households continue to adjust. Some are baking at home more often and leaning on pantry basics rather than premium ingredients, part of broader shifts in consumer behavior seen during years of price pressures. Community groups and home cooks alike report more meticulous planning, as consumers look for value without sacrificing essential nutrition.

As the inflation backdrop evolves, analysts will be watching for any further surprises in the price data that could tilt the BoE toward or away from a rate cut. The balance of risks remains uneven: consumer resilience could be tested by renewed energy price volatility or persistent wage pressures, even if the latest numbers offer temporary relief for pocketbooks. The next few weeks will help determine whether November’s cooling is the start of a longer downward trajectory or a temporary lull within a still-choppy inflation landscape.