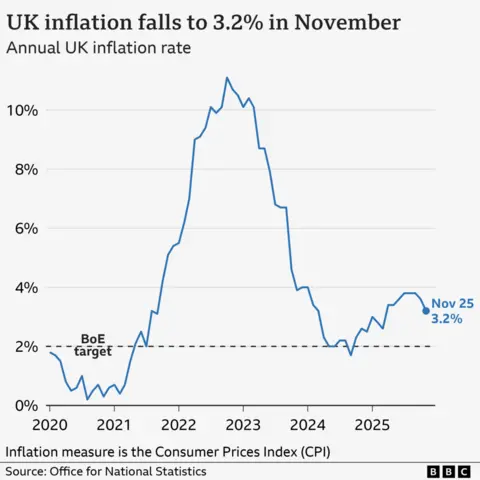

UK inflation slows to 3.2%, easing pressure on households and fueling rate-cut bets

Food-price relief and broader deceleration in price growth could influence borrowing costs and investor guidance amid a shifting inflation landscape.

Britain's inflation rate slowed in November, advancing a narrative of easing price rises after a year of unusually high inflation. Prices rose 3.2% on a year-over-year basis, the government statistics office reported, a softer pace than in October and a development analysts say could breathe a bit more room into household budgets as the holiday season approaches. The deceleration is being watched closely for its potential impact on monetary policy, with analysts suggesting the Bank of England’s Monetary Policy Committee could move to cut interest rates if the trend persists.

Food prices helped anchor the broader slowdown, with the price of food and non-alcoholic drinks rising 4.2% in the 12 months to November, down from 4.9% in October. Alcohol and tobacco were up 4% versus 5.9% in October, while some non-edible areas showed mixed movement. Beef and veal prices surged by nearly 28% over the year, while olive oil fell about 16%, and prices for flour, pasta and sugar declined. The combination of stronger grocery deflation and softer overall inflation suggests that essential items may be helping keep the yearly rate lower, a development that would particularly aid households with limited disposable income.

Clothing and footwear provided a further drag on the inflation tally, falling 0.6% in the year to November after a 0.3% rise in October. Analysts have attributed some of this decrease to retailers bringing forward Black Friday discounts as shoppers face ongoing cost-of-living pressures. The broader pattern—where some categories pull inflation down while others remain elevated—highlights how the pace of price growth is being driven by item-specific dynamics rather than a single, broad trend.

The inflation data arrives amid a changing consumer landscape. Some households have tightened budgets by sticking to pantry staples and reusing ingredients, a shift underscored by the observations of Lucy Fairs, who helps run the Band of Bakers, a cake-sharing club in Camberwell, London. She said members have been relying more on what they already have in their cupboards rather than seeking out new or premium ingredients in recent years. "When I chose a recipe for today, I thought of the theme—but more so, I thought of what I already had in my pantry," she noted. Costa Christou, another club member, echoed the sentiment, describing careful recipe selection to stretch resources.

The fall in inflation is also shaping financial planning. As price rises ease, borrowing costs could fall, supporting debt servicing for households that rely on loans or credit lines. Yet savers may not reap the same benefits, as lower inflation typically translates into tighter returns on cash deposits. "Lower inflation is good news for household budgets, but it is a different story for savers," said Sally Conway, savings commentator at Shawbrook Bank. She cautioned that some savings products could see yields shrink unless consumers adapt their strategies toward higher-yielding options.

Industry and policymakers are responding to the evolving environment. Analysts say the latest data strengthen the case for a Bank of England rate cut at the MPC’s upcoming meeting, potentially making it cheaper to borrow. At the same time, regulators are encouraging a shift toward longer-term investing as a way to enhance returns for households. The Financial Conduct Authority has approved targeted support that allows banks and financial firms to offer investment guidance, signaling a push to help consumers seek potentially higher returns beyond traditional cash savings.

Looking ahead, experts caution that the current slowdown may reflect a mix of temporary and item-specific factors, rather than a broad, irreversible trend. Factors such as harvest conditions for certain groceries and selective discounts on apparel have been cited as contributing to the latest readings. If notably stronger consumer demand or renewed price pressures emerge in the coming months, inflation could rebound from the current pace. Still, the November data add to a growing sense that price growth is moving toward the Bank of England's 2% target, a development investors and households alike will be watching closely as winter unfolds.