UK retail sales fall as Black Friday deals fail to lure shoppers

ONS data show a 0.1% drop in November; consumer confidence improves toward Christmas amid rate-cut hopes

UK retail sales fell unexpectedly in November, with volumes slipping 0.1% from October, the Office for National Statistics said Friday. Economists had expected a 0.4% rise. The weakness was broad-based, with supermarket sales down for a fourth month and discounts across November failing to lift Black Friday spending as much as in recent years.

Household demand showed some resilience in certain categories, with purchases of computers, clothing and furniture higher than a year earlier in the months around November. In a separate ONS consumer survey, 31% of adults said they planned to take advantage of Black Friday deals, while 19% said they planned to buy less than last year, highlighting a cautious approach among shoppers ahead of the holidays. Separately, data published by GfK showed December consumer confidence at a 16-month high, with households more positive about their finances in the year ahead, though sentiment remained subdued.

Oliver Vernon-Harcourt, head of retail at Deloitte, said the cut in interest rates to 3.75% on Thursday could strengthen shoppers' confidence and spur a rebound in spending during the crucial pre-Christmas period. The Bank of England's survey of businesses also suggested consumers were keenly focused on value for money, with companies regularly citing the Budget as a factor dampening spending in recent months.

AJ Bell head of financial analysis Danni Hewson said speculation about Budget measures was to blame for unnerving consumers at the very peak of the festive shopping period. Mountain Warehouse chief executive Mark Neale told the BBC that Budget speculation had been unhelpful to the industry, although his company had posted a record sales period.

The ONS's household survey indicated that 31% of adults planned to take advantage of Black Friday deals, while 19% expected to buy less than last year, underscoring a split between pent-up demand and prudence as the holidays approach.

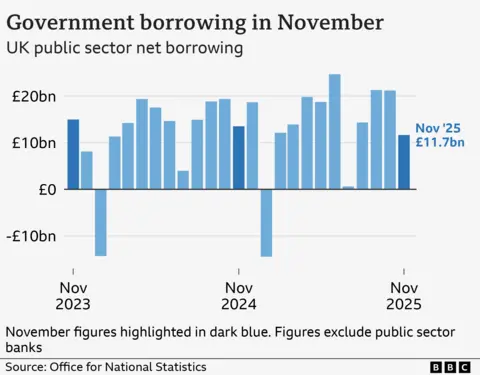

Separately, the ONS announced that UK government borrowing was higher than expected in November. Borrowing — the difference between public spending and tax income — was £11.7 billion in November, versus a forecast of about £10 billion, though the figure was £1.9 billion lower than in November last year and marked the lowest November borrowing for four years. Government borrowing for the financial year to November reached £132.3 billion, about £10 billion higher than at the same point last year. Part of the rise reflected the reversal of a decision to restrict winter fuel payments, higher public-sector salaries, and inflation-linked benefits.

Chief Secretary to the Treasury James Murray said last month's Budget would deliver on the pledge to cut debt and borrowing. He added that "£1 in every £10 we spend goes on debt interest — money that could otherwise be invested in public services." Shadow chancellor Mel Stride argued that the government was piling up ever higher debt, criticizing Labour's welfare reforms.

Matt Swannell, chief economic adviser to the EY Item Club, said the government would need to deliver a significant slowdown in borrowing over the next few months if it is to hit the Office for Budget Responsibility's target of £138.3 billion for the current financial year.

Overall, the data present a mixed picture for the run-up to Christmas: consumer confidence has improved, but spending remains cautious and the borrowing trajectory remains tightly watched by policymakers and markets.