Utilico Emerging Markets Trust rides dividend momentum as it expands global footprint

Dividend-growth leader joins FTSE 250 and eyes data centers and utilities across Asia and the Americas as managers hunt for new opportunities.

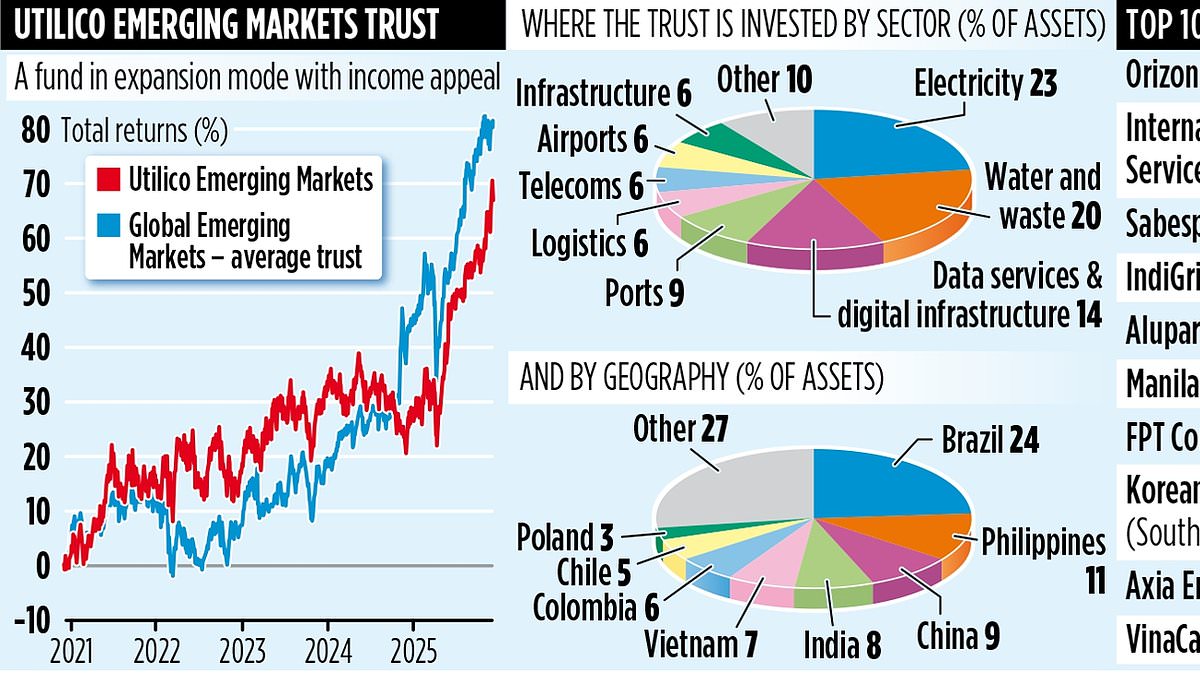

Utilico Emerging Markets Trust has had a strong year for shareholders, with its share price up more than 20% and a steady stream of growing dividends. The trust also joined the FTSE 250 index and has earned recognition as an early-stage 'dividend hero' for increasing income payments to shareholders every year for the past decade. That combination of price strength and income growth stands out in the spectrum of emerging markets funds, most of which have a broader tilt toward other sectors.

Joint managers Charles Jillings and Jacqueline Broers, along with senior analyst Mark Lebbell, recently returned from a two-week tour to South Asia that included visits to China, Hong Kong, Malaysia, the Philippines and South Korea. "It was a look into the future," Jillings said of the trip. The team observed advances such as driverless vehicles and flying taxis while meeting management teams and speaking with local brokers who close to the investment ground.

The trip also yielded a small investment in Chinese data center operator GDS, a company the managers say they have high confidence in. World-wide demand for data centers, driven by the uptake of artificial intelligence, supports the team’s view that GDS has an attractive international footprint in places such as Malaysia and Thailand. The plan is to continue building the stake as the position is refined through ongoing meetings with management and local brokers. In February, Jillings and his colleagues plan another overseas swing, this time to Central and South America, including Brazil, Chile and Mexico, to repeat the process and further assess opportunities.

Brazil already accounts for nearly a quarter of the trust’s assets, and the managers say the country, along with Chile and Mexico, presents tantalizingly interesting prospects as emerging markets seek to capitalize on long-run growth drivers. The February trip signals the managers’ preference for a hands-on, on-the-ground approach to sourcing ideas and validating business quality before committing more capital.

The trust, valued at about £476 million, comprises 70 holdings. The portfolio’s investment style remains income-oriented, with roughly 80% of holdings paying a dividend. Annual charges total 1.5%, and distributions are paid quarterly, generating an expected annual income of about 3.5%. The fund trades under the ticker UEM and is identified by the code BD45S96.

The portfolio’s tilt toward utilities—energy providers, telecoms operators, water and waste utilities—helps differentiate Utilico from many emerging markets funds that lean heavily toward information technology, financials or consumer-oriented companies. Jillings says the unifying thread across holdings is not a single sector but the quality of management teams and the strength of their business models, particularly their pricing power.

International Container Terminal Services, a Philippines-based operator with activities in 19 countries, sits among the fund’s top ten holdings. Over the past five years, its container-throughput volume has grown about 5% annually, while revenues have risen roughly 13% a year. In the nine months ending September this year, volume growth neared 12%. Jillings notes that, even amid tariff rhetoric that has unsettled some trade flows, global trade remains robust and emerging economies are beneficiaries.

The managers emphasize that the focus on income does not come at the expense of capital appreciation. By seeking businesses with durable models and pricing power, they aim to deliver total returns for shareholders through both capital gains and rising income over time. The approach contrasts with peers that may chase momentum in sectors with different risk and return profiles, but the team asserts a disciplined process built on encounter-driven research and ongoing dialogue with company managements.

As the year draws to a close, Utilico’s leadership stresses that the fund’s diversification within the utilities and infrastructure arena, together with a growing exposure to data-center operators and other long-duration assets, supports a resilient income stream in a changing global macro environment. With the Asia and Americas trips already underway for 2025–26, investors will be watching how the portfolio evolves and whether the dividend track record can be sustained as new opportunities are incorporated.