Walmart builds pipeline of skilled trades to keep stores running

Retailer revamps in-house training and expands sites to train maintenance technicians amid growing labor shortages

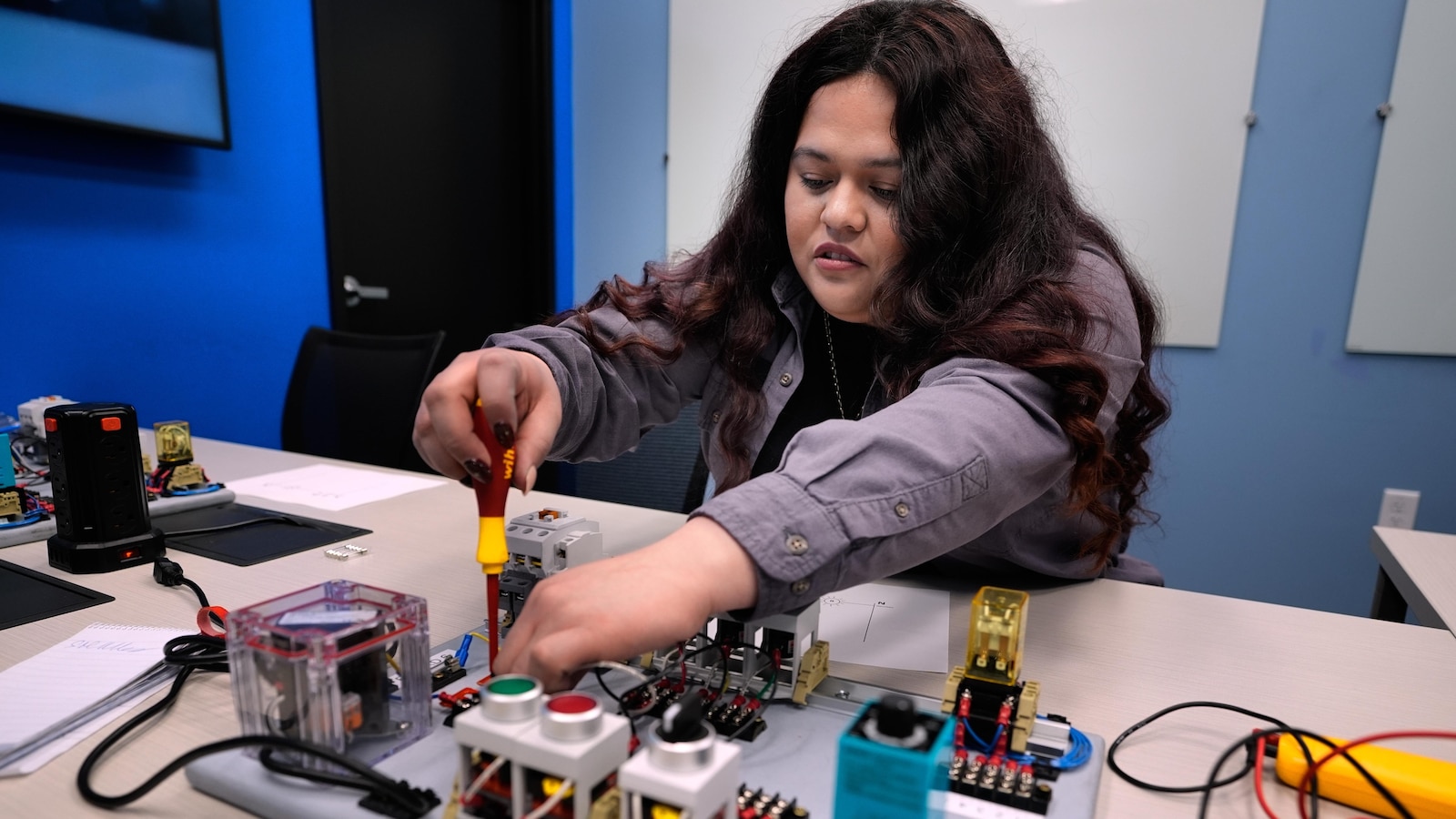

As the number of skilled tradespeople dwindles in the United States, Walmart is expanding its own workforce through a revamped training program designed to funnel maintenance technicians into distribution centers and stores, roles that keep conveyor belts moving, refrigerated cases cold, and drains and parking lots flowing. The nation’s largest retailer and private employer has overhauled its approach to training to address a labor shortage that has grown more acute in skilled trades such as maintenance, welding, carpentry, and related fields.

The program was overhauled in the spring of 2024, with a tuition-free, in-house training initiative launched in the Dallas-Fort Worth area that blends hands-on instruction with classroom learning in heating, ventilation, air conditioning, electrical work, and general maintenance. This year the company added training sites in Vincennes, Indiana, and Jacksonville, Florida, expanding access to workers nationwide. The effort reflects Walmart’s aim to secure a stable pipeline of technicians to support its distribution network and store operations as retirements rise and the pool of qualified applicants tightens.

As of mid-November, the program had produced nearly 400 graduates. The first class of 108 associates who completed the Dallas-Fort Worth pilot program secured technician roles, and the company has said graduates on average earn about $32 per hour, with the opportunity for faster advancement as skills grow. Walmart has set a goal of putting 4,000 workers through the training by 2030, a target that would help the retailer reduce dependence on external hires for maintenance and repair work and improve uptime across its warehouses and stores.

R.J. Zanes, vice president of facility services for Walmart and Sam’s Club, said the company has drawn applicants from a wide range of backgrounds, including former cashiers and other frontline workers, broadening the pool by appealing to people who might not have initially considered a career in maintenance. He stressed the importance of preventative maintenance and rapid response to breakdowns to minimize downtime and the substantial cost of outages. For example, a refrigeration outage in a Walmart store could lead to hundreds of thousands of dollars in lost product, underscoring why the company emphasizes staying ahead of equipment needs.

The push comes amid broader industry concerns about skilled-trades shortages. Consulting firm McKinsey analyzed 12 trade job categories, including maintenance technicians, welders, and carpenters, and projected an imbalance of roughly 20 job openings for every net new hire from 2022 through 2032. The report highlighted the high churn in these roles and estimated that talent acquisition and training costs could exceed $5.3 billion annually for U.S. companies. The shortage is weighing on operations as some employers also trim costs amid tariff-related price pressures, shifting consumer demand, and rising automation and artificial-intelligence investments. In June, Business Roundtable launched an industry-wide effort, co-led by Lowe’s, to build a pipeline of skilled trades by partnering with schools to raise awareness among younger generations about in-demand trades.

Walmart’s chief executive, Doug McMillon, told The Associated Press that the shortage is partly a function of awareness. He said many Americans do not know what a role as a maintenance technician entails or the potential earnings, and he argued there is a need to better educate people about these career paths so they can pursue them.

The company’s 2024 training overhaul is designed to be scalable, with ongoing expansion into new markets. In addition to the initial Dallas–Fort Worth program, Walmart added sites in Indiana and Florida this year, and it plans to continue building out networks that can feed the company’s operations with qualified technicians. The program’s early results — including graduates who immediately step into roles with an average $32 hourly wage — provide a model for how large retailers might address persistent labor shortages in essential maintenance functions across the supply chain.

Liz Cardenas, a 24-year-old who started at Walmart in May 2023 as an automation equipment operator at a distribution center in Lancaster, Texas, illustrates the path from frontline worker to skilled technician. She oversees repairs to conveyor belts and other equipment when breakdowns occur. Cardenas, who has nearly doubled her hourly pay to $43.50, plans to pursue additional training that would bring higher pay and more responsibility. The program has not only boosted earnings but also personal financial independence, she said, enabling her to move into her own apartment, buy a car, and contribute more to her 401(k).

The focus on preventative maintenance and rapid recovery aims to keep distribution centers and stores operating efficiently, especially during peak holiday periods. Walmart officials say the ability to keep critical systems online reduces the risk of costly downtime and protects product integrity and shelf availability.