Warning signs mount as markets edge toward potential crash, veteran City journalist warns

A longtime financial columnist points to speculative bets, record highs and rising debt as indicators of a possible downturn, urging vigilance among policymakers and investors

A veteran City journalist warns that the global financial system may be headed for a historic crash, arguing that a convergence of exuberant markets, outsized bets and mounting debt is creating a fragile environment. The columnist notes that warning signs have intensified across equities, debt markets and even segments of the technology sector, and he warns that the consequences could ripple through employment, retirement prospects and social stability if investors and officials fail to heed them.

Last week Brera Holdings, a firm that owns stakes in football clubs, announced an intention to buy cryptocurrency tokens. The move triggered explosive trading, with the company’s shares rising by almost 600% in a single session before retreating to around 225% gains. Brera’s portfolio includes Brera Ilch, a club that finished last in the Mongolian League, along with squads from North Macedonia and Mozambique, not the high-profile European names commonly cited in market chatter. The episode is cited as a vivid illustration of the era’s feverish risk appetite, a phenomenon the columnist associates with the so-called bezzle—the stage in which overheated markets entice even otherwise prudent participants to assume the upside will continue indefinitely. Backers include Emirati investors and prominent market figures, underscoring how broad the speculative wave has become. While the columnist says he wishes Brera well, he stresses that the broader financial picture shows troubling evidence of risk building toward a potential crash.

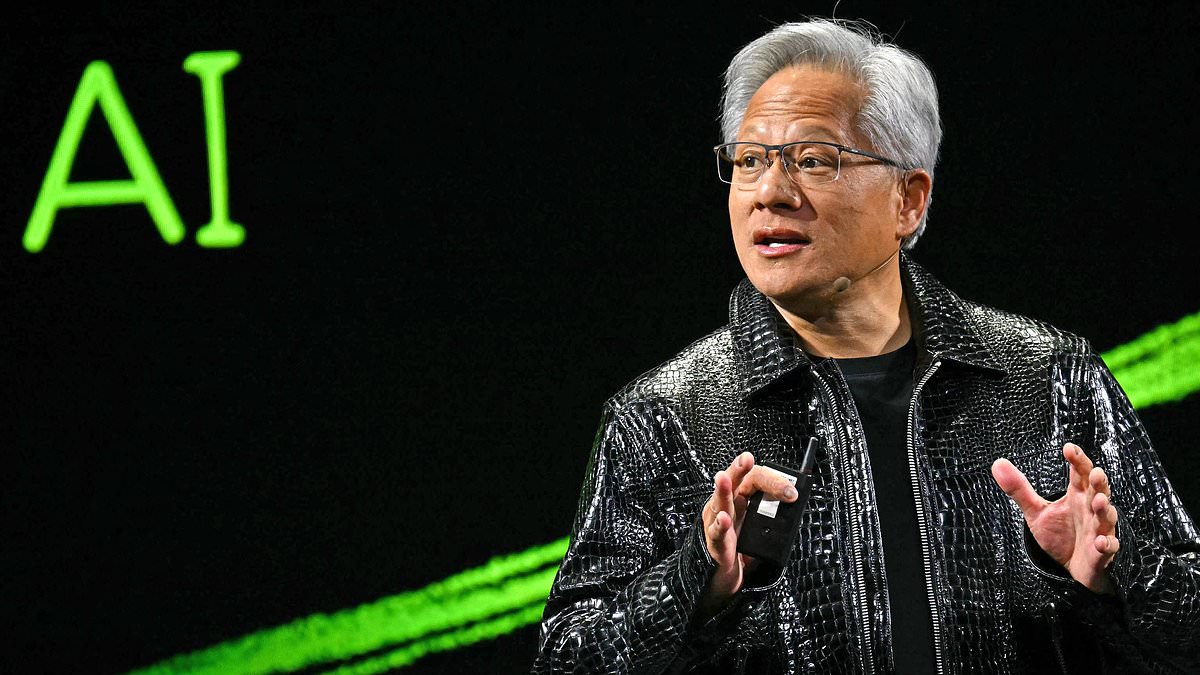

The column flags a number of stark market markers. Nvidia’s decision to invest $100 billion in OpenAI is presented as a symbolic outlay for today’s era—so large that it eclipses the entire value of major consumer goods companies and even the oil giant BP, and is larger than the $72 billion OpenAI has drawn over its decade-long history. The investor commentary acknowledges that AI models such as OpenAI’s ChatGPT may reshape productivity and the global economy, yet it also notes that the energy demands of such technologies are substantial, roughly the equivalent of ten new nuclear reactors, a timetable likely stretching over many years. The adage that markets scale to their zenith appears particularly resonant given that most of the world’s stock indices—Dow Jones, Nasdaq and S&P 500 in the United States; the Nikkei in Japan; and Britain’s FTSE 100 and FTSE 250—are trading near or at all-time highs. The price of gold has surged to a fresh record of about $3,791 per ounce, and Bitcoin has hovered near its own all-time highs, around $124,000 per coin. Critics have long warned that such price action can be the hallmark of speculative mania, a sentiment famously dismissed by some investors and commentators alike.

With markets stretched, the columnist turns to debt as a core risk driver. He notes that long-term yields on UK government bonds have risen to the highest levels seen since 1998, and that Britain's debt load is now around 100% of GDP—the highest peacetime level on record. The situation is echoed elsewhere: France’s government debt has climbed to roughly 114% of GDP, while the United States is approaching about 140% of GDP following tax policy shifts and fiscal actions. An International Monetary Fund official, Vítor Gaspar, has warned that global debt now totals about 235% of world output, with government debt the principal driver. The private debt market is not immune to stress either, as exemplified this week by car lender Tricolor Holdings and car-parts supplier First Brands Group seeking emergency financing to avoid bankruptcy.

The piece also surveys policy and trade dynamics that shape risk appetite. Tariffs, the columnist argues, act as a tax on consumers and can exacerbate inflation and economic fragility. Tariff-related revenue has surged, but the broader economic costs—higher import prices and potential retaliation—are a destabilizing factor for growth. The writer warns that tariff wars were a major contributor to the Great Depression of the 1930s, when global GDP contracted sharply and unemployment spiked, with long-run social and political consequences.

Against this backdrop of high prices and fragile debt, the columnist contends that the market environment is driven by computer algorithms and, increasingly, AI-enabled trading. When panic selling begins, monetary authorities may struggle to stem the tide. The piece cites the 1987 Black Monday episode as a reminder of how rate policy and market mechanics can interact to produce cascading declines, and it warns that the current generation of trading systems could magnify such episodes rather than contain them. Taken together, these threads paint a picture in which the world economy and financial markets appear to be perched on a precipice, with the risks accumulating faster than policymakers and market participants can respond.

The column closes with a stark warning: the dreaded alignment of overheated markets, rising debt and policy frictions creates a setup for a downturn that could prove deep and protracted. It argues that too few politicians, officials and market participants fully recognize the magnitude of the risk, and that, once warning signs crystallize into a real crisis, it could be too late to act. In short, the writer says the current moment resembles a period when the mismatch between optimism and fundamentals is wider than at any time in recent memory, and the potential consequences are grave for workers, retirees and economies worldwide.