Warning signs mount as markets near peaks, Brummer warns of looming crash

A veteran City columnist flags bezzle-like speculation, record debt and outsized bets in tech as indicators of a potential downturn.

A veteran financial columnist warns that a major market crash could be looming, pointing to a confluence of warning signs across global markets. In a column published this week, Alex Brummer notes a striking episode on the New York Stock Exchange: Brera Holdings, a company that owns stakes in football clubs, announced plans to buy cryptocurrency tokens, sparking an extraordinary rally that sent its shares higher by as much as 600% in a single day before settling around a 225% gain. The move underscored the era’s appetite for high-risk bets and the kinds of moves that commentators say resemble speculative mania more than traditional investing.

It is notable that Brera’s holdings include Brera ILCH, a club that finished last in Mongolia’s league, along with other squads in North Macedonia and Mozambique. Brummer points to this episode as an illustration of a broader pattern of speculative fervor that economist J. K. Galbraith described as the bezzle, a situation in which markets become so overheated that even serious and respectable investors convince themselves that the only direction is up. The piece notes Brera’s backing by Emirati investors and Wall Street pioneer Cathie Wood, underscoring how influential figures and nontraditional assets have become entangled in today’s market dynamics. The author argues that such episodes are emblematic of a market environment where risk-taking is pervasive and correlations are increasingly opaque, creating a fragile foundation for asset prices.

The column also links this behavior to a wider sense that the financial world is entering dangerous territory. It argues that the kind of exuberance seen in Brera’s move is not isolated, but part of a broader pattern driven by ultra-loose monetary policy and strong liquidity that has helped lift valuations across equities, bonds, and alternative assets.

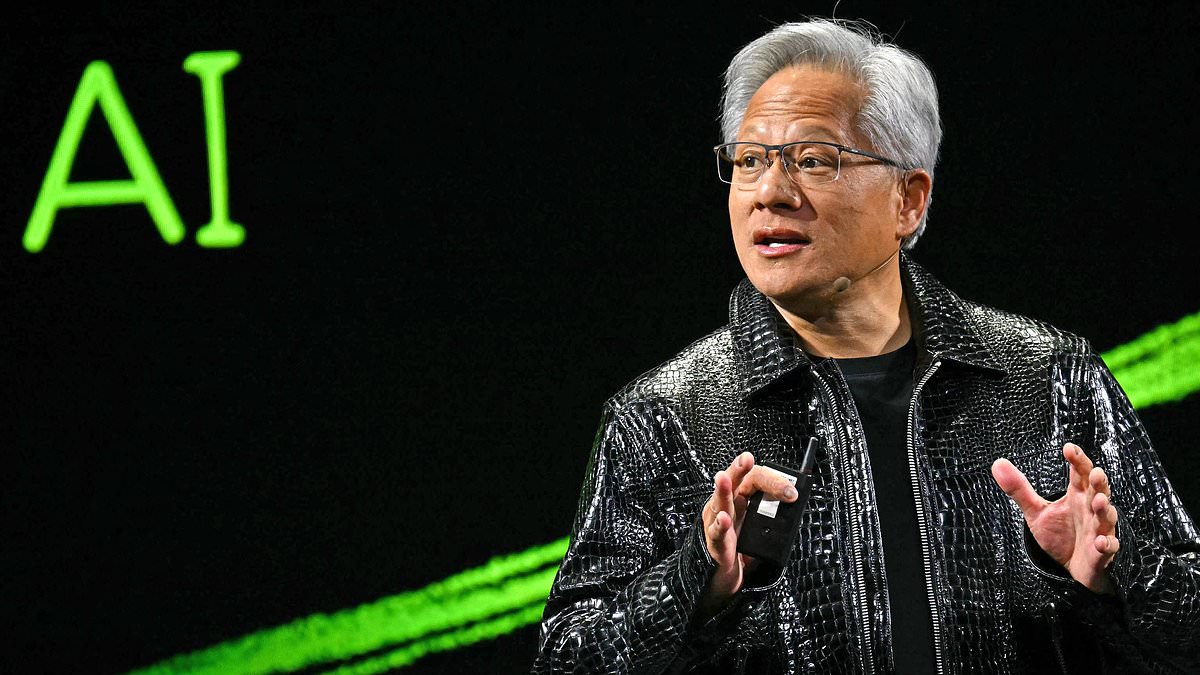

Beyond equity markets, the piece highlights one of the era’s most talked-about signals: the Nvidia-OpenAI investment. Nvidia announced a $100 billion commitment to OpenAI, a sum that Brummer says dwarfs the market value of some major corporations and eclipses the $72 billion OpenAI has received over its ten-year history. The author notes that such an outsized bet reflects a market at or near its apex, where valuation growth is increasingly decoupled from traditional fundamentals. The author also points to the energy implications of AI models, noting their substantial electricity needs — roughly the equivalent of the capacity of ten new nuclear reactors — which could matter for policy, energy markets, and inflation in the longer run.

Global stock markets appear to be at or near all-time highs. From the Dow Jones, Nasdaq and S&P 500 in the United States to the Nikkei in Japan and Britain’s FTSE 100 and FTSE 250, most major indices are trading near peak levels. In parallel, the gold market has reached a fresh record, with prices around $3,791 per ounce after a year in which the metal advanced about 44%. Bitcoin, the largest cryptocurrency by market capitalization, hovers just below its all‑time high of around $124,000 per coin, illustrating the breadth of speculative appetite across assets perceived as hedges or high‑risk investments. Even Warren Buffett’s longstanding skepticism about Bitcoin—he has called it “rat poison squared”—is cited as a counterpoint to the prevailing mood of exuberance, underscoring the tension between value investing and speculative mania in today’s markets.

The piece proceeds to a more sobering ledger of debt and funding pressures. It notes that debt levels are rising across major economies: UK government bond yields rose to their highest since 1998, a sign of rising borrowing costs and shifting risk sentiment. British payrolls have shed about 178,000 jobs since last autumn’s £40 billion budget measures, fueling concerns about the strength of domestic demand. Across the Atlantic, the Federal Reserve described downside risks to employment as part of its cautious posture while cutting rates, reflecting a balancing act between supporting growth and guarding against overheating. The author highlights the broader debt picture: UK debt stands near 100% of GDP, France around 114%, and the United States heading toward roughly 140% of GDP, all pointing to serious long‑term fiscal pressures.

International institutions have added their warnings. IMF official Vítor Gaspar cautioned that global debt levels have risen to about 235% of world output, with government debt as the principal driver. Private debt markets show fragility as well, with companies such as Tricolor Holdings and First Brands Group seeking emergency financing to avoid bankruptcy. The column also recalls that tariff policies, including ongoing disputes and tariff implementations, have direct consequences for consumer prices and corporate margins. In the author’s view, tariff increases have lifted costs for importers and could weigh on demand, a dynamic that previously contributed to recessions in prior eras. The piece also notes that tariff wars were a key driver of the Great Depression in the 1930s, a reminder of how protectionist measures can amplify economic distress if not managed carefully.

The warning is not just about numbers. Brummer writes as a financial journalist with more than five decades of experience, one who has watched cycles come and go. He argues that while the current era promises unprecedented productivity and technological progress, the accompanying risk of a sudden market reversal is real. He notes that the last true recession in many observers’ lifetimes occurred during the 2008–2009 crisis, and that the current bull run has lasted long enough to raise questions about its durability. In his view, the combination of speculative excess, fragile debt dynamics, and policy‑driven liquidity creates a setup in which a shock could propagate quickly through markets, turning a loss of liquidity into a broader financial downturn. If policymakers and markets fail to recognize and respond to these warning signs in a timely manner, the author cautions, the downturn could arrive with little warning and broad consequences for employment, retirement prospects, and social stability. The world, he writes, appears to be teetering on a precipice, and once a panic begins, intervention may come too late.