Waterstones eyes 2026 London float amid IPO revival

Activist investor Elliott weighs Waterstones and Barnes & Noble spin-off as London IPOs look revived

Waterstones is examining a London listing as early as 2026, a move that would signal a broader revival in stock-market listings. The book retailer, owned by Elliott Management since 2018, is weighing options including a spin-off of Waterstones alongside its U.S. counterpart Barnes & Noble. The prospect underscores the activist fund strategy of unlocking value in assets it has owned for years and is seen as part of a wider push to revive attention to listed consumer businesses in the United Kingdom.

People briefed on the matter said London or New York could be on the table, with the United Kingdom seen as the front runner. Elliott declined to comment, but a source said everything remains on the table and that timing would depend on market conditions and regulatory review.

London has begun to see pockets of IPO activity after a quiet period. Earlier in December 2025, Princes Group and Shawbrook listed in London, and analysts watched as the RAC motorist services group weighs a flotation next year. The uptick in listings reflects a more constructive market environment for consumer-facing and financial services companies seeking primary capital.

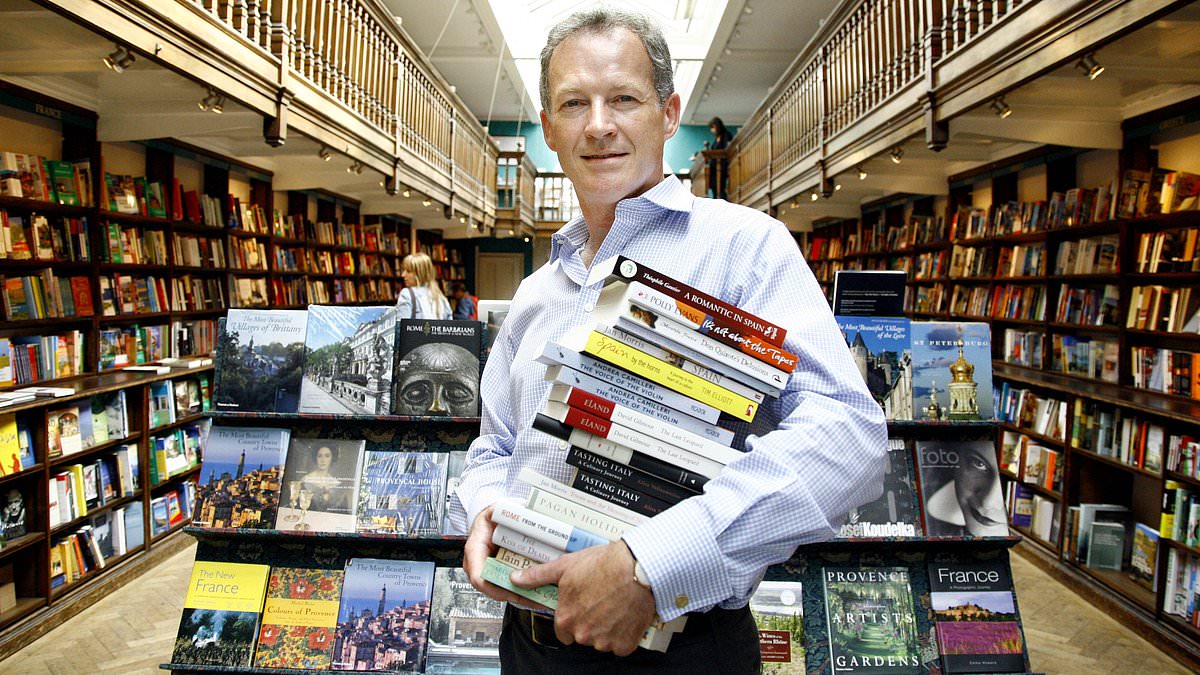

Waterstones has staged a sharp turnaround under chief executive James Daunt since he took over in 2011. Daunt also runs the Daunt Books chain. The turnaround was so influential that Elliott later appointed him to lead Barnes & Noble during its revival after the 2019 acquisition, a move designed to streamline the two businesses and share best practices across markets.

Analysts say a Waterstones listing would mark a notable milestone for the London market and could unlock value for long-term holders. Observers note that a spin-off structure could allow Waterstones to focus on book retailing while Barnes & Noble pursues its own growth plan in the United States, though the exact structure remains under discussion.

Until a firm timetable is set, investors and industry watchers will monitor any filings or statements from Elliott about the potential listing. The broader environment for IPOs in London remains sensitive to macro conditions, but the revival in late 2025 offers a potential path back to regular listings for major growth stories.