Waterstones eyes 2026 London float as IPO revival broadens

Activist Elliott Management weighs spin-off of Waterstones and Barnes & Noble; London listed as front-runner amid renewed market activity

Waterstones is weighing an initial public offering in London in 2026, as the revival in stock-market listings gains momentum, according to people familiar with the matter. The activist fund Elliott Management, which bought Waterstones in 2018, is understood to be considering a spin-off of Waterstones and its U.S. counterpart Barnes & Noble. Options include a London listing or a New York listing, with London viewed as the front-runner. Elliott declined to comment, but a source said: "Everything is very much on the table."

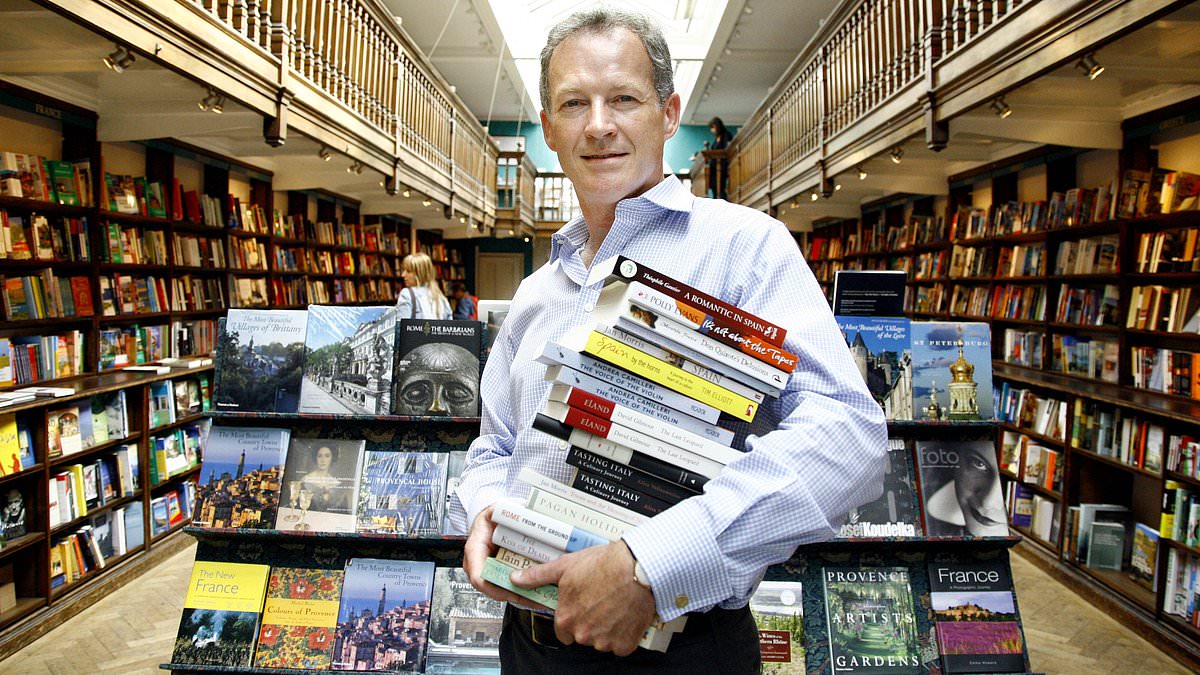

The potential flotation would cap a dramatic turnaround under Waterstones chief executive James Daunt, who took the helm in 2011 and also owns the Daunt Books chain. Daunt's revival has been cited as a key part of Elliott's confidence in Waterstones, a view that helped the activist investor later back his leadership of Barnes & Noble after its 2019 acquisition.

Market context: with IPOs scarce in recent years, any London float would be notable. In London, Princes Group and Shawbrook staged flotations in recent weeks, and the RAC motoring group has also signaled it is weighing a 2026 float.

Decision factors and options: sources say the options include a London listing or a New York offering, with the UK seen as the likely home for the flagship. There is no firm timetable and no official comment from Waterstones or Elliott.

Waterstones' path illustrates how activist investors have used structural moves such as spin-offs to unlock value for portfolio companies. If it proceeds, a Waterstones listing would separate the bookshop chain from Barnes & Noble, potentially making two distinct retail entities in different markets.

Industry observers say any listing would be subject to market conditions and the performance of consumer-facing retailers. For Waterstones and Barnes & Noble, the goal would be to capitalize on a more favorable IPO window while continuing to invest in bookselling and digital platforms.