Waterstones eyes 2026 London float as IPO revival gathers pace

Elliott Management weighs spinning off Waterstones and Barnes & Noble; London listed as likely venue amid renewed market listings

Waterstones could pursue a London flotation in 2026, signaling a revival in stock-market listings, according to reports. The Daily Mail's City & Finance desk said activist investor Elliott Management, which bought Waterstones in 2018, is weighing options to spin off Waterstones and its U.S. counterpart Barnes & Noble. Options reportedly include a listing in London or New York, with the United Kingdom seen as the front runner. Elliott declined to comment, but a source told the publication: 'Everything is very much on the table.'

London would be the leading venue if the listing goes forward, though timing and structure remain fluid. A London float would fit into a broader wave of UK listings, as market participants have begun to revive initial public offerings after a lull. Princes Group and Shawbrook Bank have already gone public in London in recent weeks, and the RAC motoring group is weighing up a float next year.

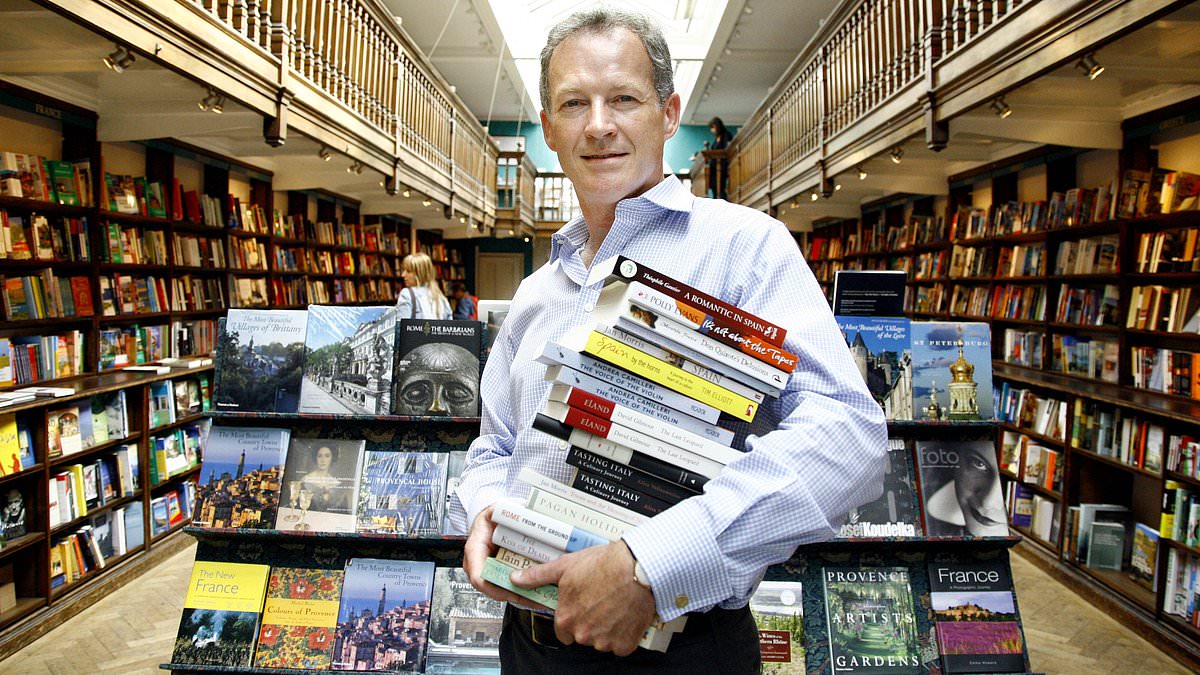

Waterstones has staged a dramatic recovery under chief executive James Daunt, who took over in 2011 and also owns the Daunt Books chain. Daunt's turnaround was so successful that Elliott later installed him to lead the revival of Barnes & Noble after its 2019 acquisition.

Any decision to list Waterstones would add a new dimension to Elliott's management of its bookstore assets and would place Waterstones alongside Barnes & Noble as potential future vehicles for capital-raising and strategic repositioning.

Market watchers cautioned that timing depends on market conditions and investor demand.