Waterstones eyes 2026 London float as IPO revival takes shape

Activist investor Elliott Management weighs spinning off Waterstones and Barnes & Noble amid improving market conditions

Waterstones is weighing a London float in 2026 as part of a broader revival in stock-market listings, according to people familiar with the matter. The options under consideration include a spin-off of Waterstones and its U.S. counterpart Barnes & Noble, with London viewed as the frontrunner among potential venues. Elliott Management, the activist fund that bought Waterstones in 2018, has not commented publicly on the plans, but people briefed on the matter said that every option remains on the table.

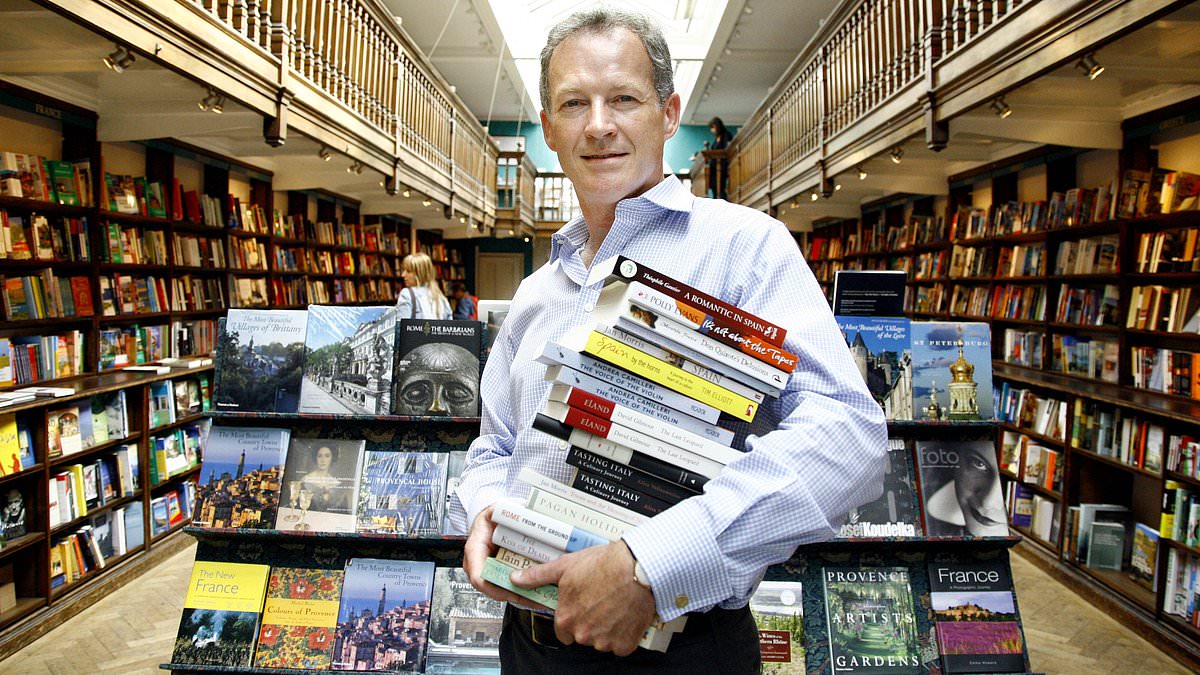

Waterstones has staged a dramatic turnaround under chief executive James Daunt since he took the helm in 2011, and he also owns the Daunt Books chain. Daunt's work at Waterstones helped attract Elliott's involvement, which later installed him to lead Barnes & Noble's revival after its 2019 acquisition. A listing in London would mark a new chapter for the bookseller and would come as the wider market shows tentative signs of revival for consumer-focused flotations.

Britain's IPO pipeline has shown signs of life in recent weeks, with Princes Group and Shawblock listing in London in December, and the RAC motoring group weighing a float for next year. The Waterstones development would be among several indicators that investor appetite for public listings is returning to more normal levels after a lull during the pandemic and a bout of market volatility.

Discussions remain preliminary, and there is no guarantee a flotation will take place. If pursued, a listing could occur in London or New York, though sources say the UK is the preferred venue.

A Waterstones float would mark a rare consumer-facing retailer's re-emergence on public markets and could lift sentiment for other listings. Any decision will depend on market conditions, readiness of the business, and the group's strategic priorities.