Waterstones eyes 2026 London float as stock-market revival gains pace

Activist investor Elliott Management weighs spinning off Waterstones and Barnes & Noble, with London seen as the likely listing venue

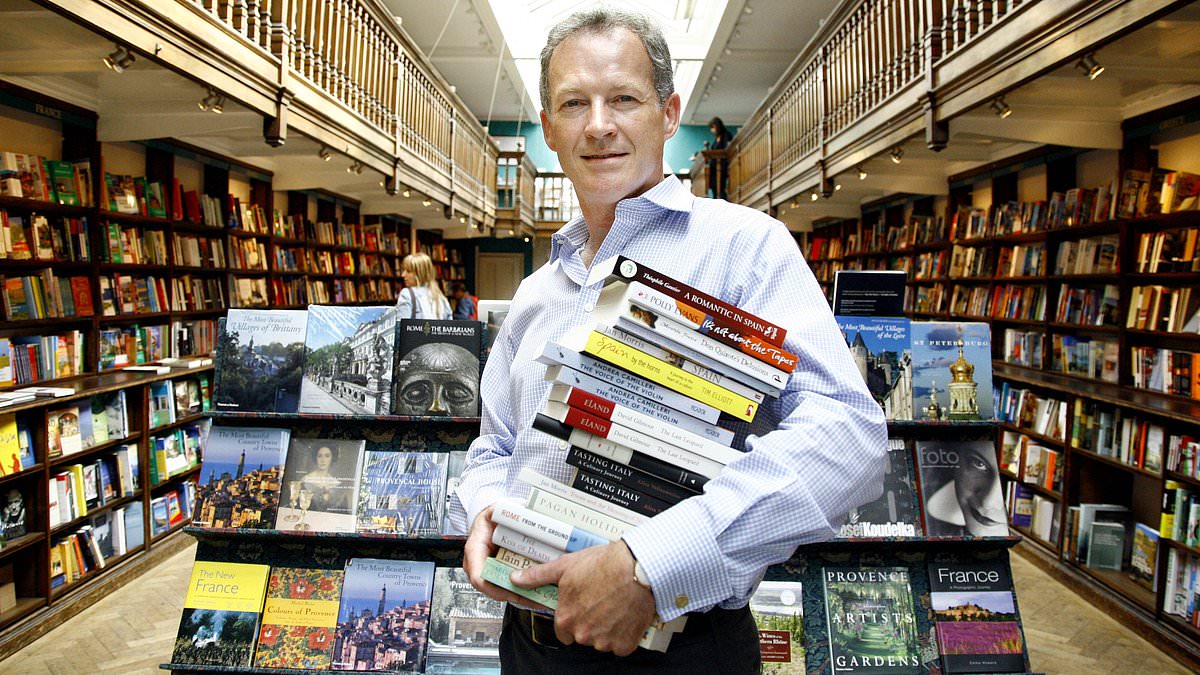

Waterstones is weighing a London float in 2026, the latest sign that stock-market listings may be reviving in Europe and the United Kingdom. Elliott Management, the activist fund that bought Waterstones in 2018, is understood to be examining options to spin off Waterstones and its U.S. counterpart Barnes & Noble. Among the options are a listing in London or New York, with the UK being the front-runner. Elliott declined to comment, but a source said: "Everything is very much on the table."\n\nLondon would be a significant boost for the market after a dearth of initial public offerings, although a handful of deals have emerged recently, including tuna group Princes Group and challenger bank Shawbrook. The RAC motoring group is also weighing up a float next year.\n\n\n\nWaterstones has staged a dramatic recovery under chief executive James Daunt, who took over in 2011 and also runs his own chain, Daunt Books. Daunt’s turnaround was so successful that Elliott later installed him to lead the revival of Barnes & Noble after its 2019 acquisition.\n\nNew chapter: Waterstones has staged a dramatic recovery under chief executive James Daunt (pictured), who took over in 2011 and also owns his eponymous Daunt Books. The effort helped secure Elliott’s support for a broader strategy that could tie Waterstones and Barnes & Noble into a unified value story.\n\nThat linkage underscores why Elliott would entertain a broader corporate strategy that could unlock value across the Waterstones and Barnes & Noble asset base. Market watchers say any listing would hinge on broader market conditions and investor appetite, with no timetable disclosed.\n\nIf a London float does materialize, it would mark a notable turn for the UK IPO market, which has seen only sporadic activity in recent years but has picked up some momentum in late 2025 as investors seek consumer-facing brands. The listing would come alongside other recently floated or considered issuances, including the Princes Group and Shawbrook, and amid talk that the RAC could pursue a listing next year.\n\n