Waterstones weighs 2026 London float as IPO revival gains momentum

Activist investor Elliott Management mulls spin-off of Waterstones and Barnes & Noble, with London seen as the likely listing venue

Waterstones is weighing a London stock-market listing in 2026, a development that would underscore a nascent revival in public-market flotations. People familiar with the plans say the options include a standalone Waterstones flotation in London or a spin-off of its U.S. counterpart Barnes & Noble, with the United Kingdom viewed as the front-runner. The discussions are being led by Elliott Management, the activist fund that bought Waterstones in 2018, as part of a broader strategy to unlock value in the book retailers’ businesses.

London, or possibly New York, is under discussion, but sources say the UK listing is favored. A London listing would come as the initial public offering market shows signs of life after a lull; Princes Group and Shawbrook have recently listed in London, and the RAC motoring group is also weighing a float next year. A source familiar with the discussions said, "Everything is very much on the table."

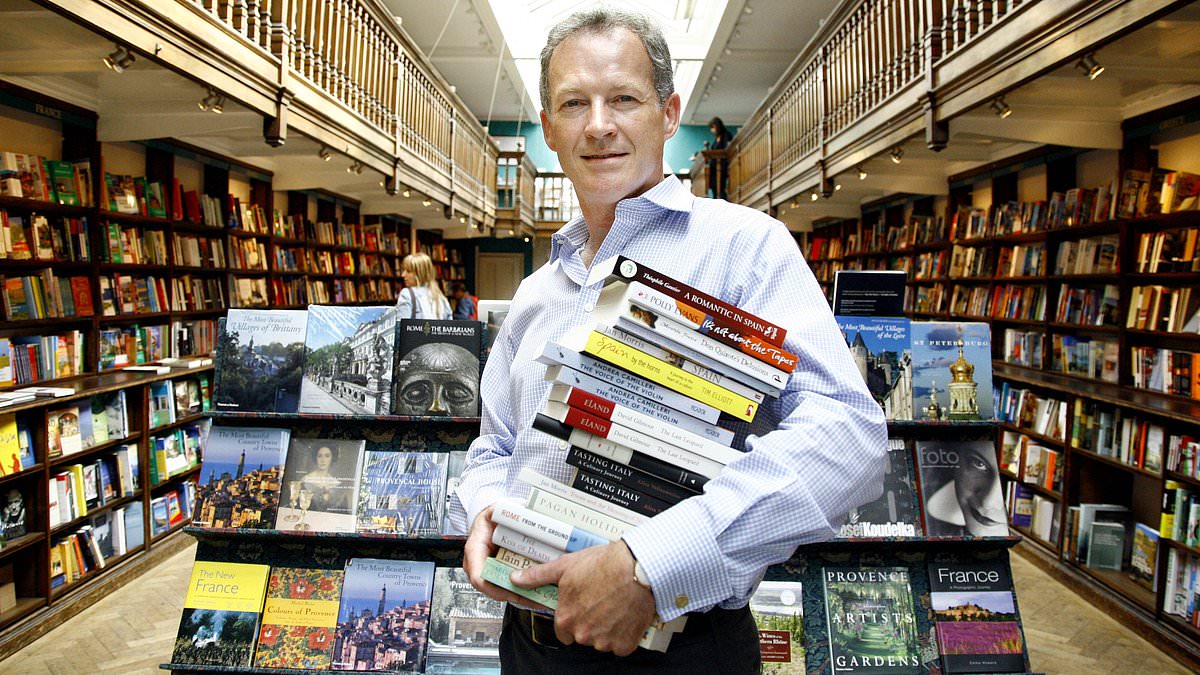

Waterstones has undergone a dramatic turnaround under chief executive James Daunt since his appointment in 2011, a transformation that helped attract Elliott’s backing. Daunt, who also owns the Daunt Books chain, was later tapped by Elliott to lead the revival of Barnes & Noble after its 2019 acquisition, a move that signaled confidence in his strategy for the higher-profile U.S. bookseller. The potential listing would reflect a broader push to monetize value created under Daunt’s leadership and to structure the business for future growth, whether as a standalone retailer or as part of a restructured group that includes Barnes & Noble.

The idea of an IPO for Waterstones sits within a wider context of renewed appetite for listings in both the United Kingdom and the United States. After a prolonged drought, a handful of mid- and large-cap floats have emerged in recent weeks, signaling that investors and banks may be recalibrating their risk appetites. The timing and structure of any Waterstones listing would depend on market conditions, regulatory considerations, and the strategic priorities of Elliott and Waterstones’ management.

Analysts note that a London float would align with other UK market activity while leveraging the country’s retail and consumer confidence profile. If pursued, the listing would mark a notable milestone for a business that has stabilized its operations and expanded its presence in a challenging retail environment. The exact timetable remains fluid, and officials close to the matter declined to comment publicly.