CBS releases Trump-free 60 Minutes fall trailer after $16 million settlement

The Trump-free preview arrives as CBS and Paramount settle a lawsuit over a Harris interview and face broader political-media scrutiny.

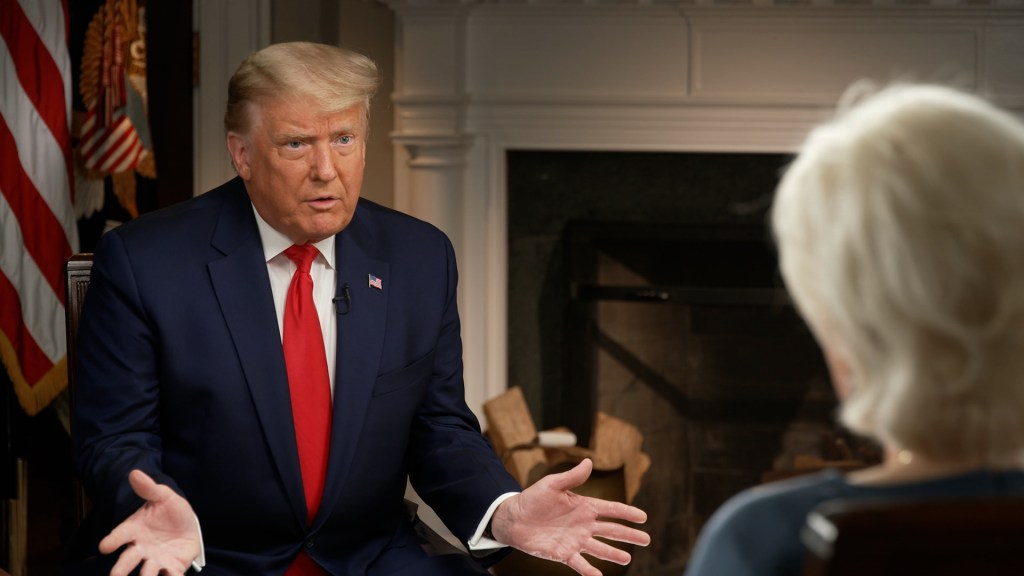

CBS released a Trump-free trailer for the fall season of 60 Minutes, a two-minute-50-second preview that omits any reference to President Donald Trump. The trailer arrives as the network and Paramount Global completed a settlement this year over claims that a 2024 interview with then-Vice President Kamala Harris was edited to appear more articulate ahead of the election. The settlement, announced in July, totaled about $16 million and followed an ongoing broader dispute over how the network handled political content in its reporting and promos.

The Trump-free trailer marks the start of Season 58 for the long-running newsmagazine and foregrounds a mix of topics, including a report tied to Charlie Kirk’s alleged assassination last week, developments in artificial intelligence, and even bird-watching. It runs through a variety of stories while notably excluding any mention of Trump. In contrast, CBS’s season 57 trailer, released Sept. 10, 2024, included a ten-second feature on the Jan. 6 attacks and an interview with a Trump supporter who contended the 2020 election was rigged. The contrast underscored how the network has approached political content in recent years in light of outside pressures and settlements.

The July settlement between CBS/Paramount and plaintiffs also included about $20 million in advertising and public service announcements from Skydance Media, which took control of Paramount later in July. Skydance is led by David Ellison, the son of Oracle co-founder Larry Ellison, a noted ally of former President Trump. The settlement fed into internal tensions at Paramount, where staffers reportedly expressed frustration with Shari Redstone, the company's controlling shareholder, over what some viewed as concessions under political and regulatory pressure. Paramount said at the time that it remained focused on its strategic priorities, including its long-planned merger with Skydance, a process subject to FCC scrutiny and other regulatory considerations.

The broader industry context around the period included high-profile actions by other networks and figures linked to political discourse. ABC suspended Jimmy Kimmel “indefinitely” after he made remarks suggesting right-wingers were politicizing the Kirk case and implied the killer might have been a MAGA conservative. Sinclair and Nexstar, two major owners of ABC affiliates, quickly pulled Kimmel’s show from the air. Nexstar, which owns 32 ABC affiliates, has been seeking FCC approval to acquire Tegna, a deal that would expand its reach across the ABC network and potentially test the nationwide cap on how many households can be reached by a single owner. The dispute reflected ongoing tensions over how media license holders respond to political commentary and calls for regulatory action.

The episode also featured comments by FCC Commissioner Brendan Carr, who said there could be consequences for networks he views as failing to meet public-interest obligations. Carr asserted that networks with TV licenses have an obligation to serve the public interest and argued that Kimmel’s remarks crossed a line, denying any perceived link to anti-Trump politics. He later said his stance was about public-interest obligations, not political loyalties. In parallel, court documents released around the same time showed that the mother of Tyler Robinson, the man accused in a murder case associated with Kirk’s death, told investigators her son had become more political and had leaned more to the left, adding a further dimension to the national debate over how crime, politics and media intersect online and on air.

The Trump-free trailer’s release reflects a broader pattern in entertainment-news programming where networks calibrate political messaging amid litigation and regulatory scrutiny. The 60 Minutes preview emphasizes investigative reporting and technology-adjacent storytelling while distancing itself from the political controversy surrounding past interviews and the broader media ecosystem. Analysts say the move could be interpreted as CBS signaling a return to traditional, issue-focused coverage within the entertainment framework of a prominent fall lineup, even as other networks navigate licensing, mergers and the volatile politics of prime-time discourse.

The timing also matters against the backdrop of ongoing consolidation and interoperability in the media landscape. Paramount’s ongoing regulatory considerations with Skydance and the broader stake held by Shari Redstone in CBS-parent company ViacomCBS have raised questions about how corporate strategy intersects with journalistic independence and the ability to manage political risk. While CBS said it remains committed to delivering a robust fall slate, the public settlement and the surrounding controversy have underscored how entertainment and news divisions operate in a tightly watched environment where viewers increasingly expect transparency about how coverage is framed and promoted.

Looking ahead, CBS did not comment immediately on further edits to its fall season or potential shifts in promotional strategy. The industry will likely watch whether the Trump-free approach persists in additional previews or if other political content surfaces in promos for 60 Minutes or sister programs. The network’s ability to balance serious investigative reporting with entertainment value — all while navigating legal settlements, regulatory scrutiny and evolving viewer expectations — will be a focal point for media observers in the weeks ahead.