Star-Studded Pierre Board Meeting Highlights Rift Over $2B Sale Proposal

Residents including Tory Burch and Howard Lutnick clash at Sept. 17 Pierre meeting as bidders circle the Central Park co-op-hotel with a roughly $2 billion offer and a path to overhaul the landmark

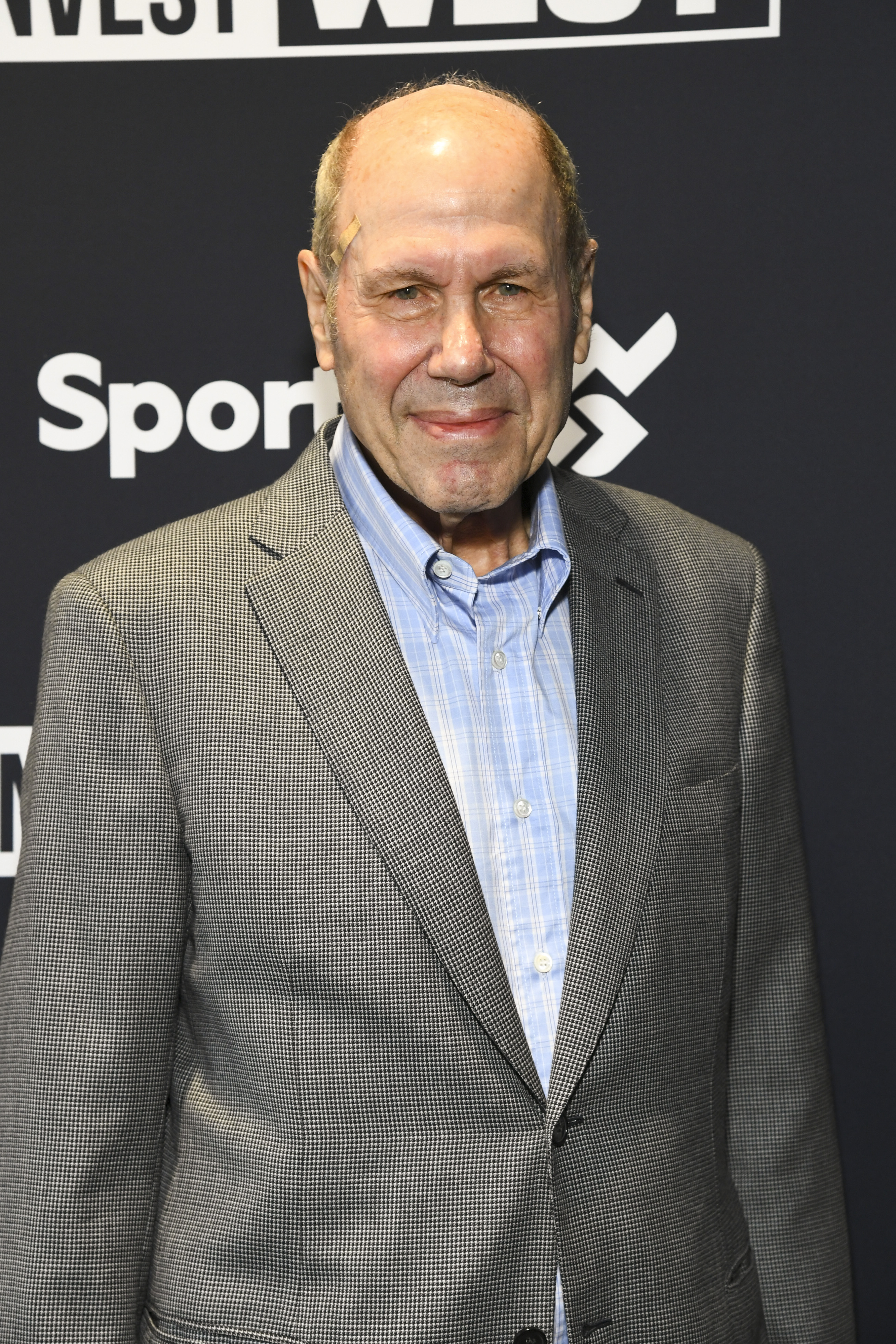

A Sept. 17 board meeting at the Pierre, the celebrated co-op and hotel perched above Central Park, devolved into a highly charged confrontation over a proposed $2 billion sale that could redraw one of Manhattan’s most storied properties. In a room known for privacy and prestige, residents were confronted with a plan that would move them from their homes and upend a building long defined by its glittering guest list. The gathering drew a who’s who of owners and tenants, including billionaire fashion mogul Tory Burch, who has long lived in two Pierre units, and Howard Lutnick, the founder and chief executive of Cantor Fitzgerald who owns the largest residence in the building but has never moved in. Former Walt Disney Co. president Michael Eisner is also a noted Pierre veteran, and media scion Shari Redstone is another resident. The scene underscored a broader dispute over the Pierre’s fate as a group of bidders eye a property that has grown increasingly expensive to maintain.

The meeting took place as a formal process unfolds around a $2 billion bid to buy the Pierre from its cooperative owners. The plan would revitalize the property and could place management in the hands of an outside hospitality operator, with potential involvement from the Saudi Khashoggi family and the Dorchester Collection, the Brunei-backed luxury chain that operates the Beverly Hills Hotel, Le Meurice in Paris and the Dorchester in London. Taj Hotels currently manages the Pierre, and the negotiations have spurred a debate about whether a sale is in the building’s best long-term interest or simply a windfall for investors and shareholders.

The Pierre’s celebrity pedigree—ranging from Elizabeth Taylor and Yves Saint Laurent to Aristotle Onassis—has never shielded it from practical concerns. In recent months, residents and observers have described a property that could use upgrades and more reliable service. Yet the tone of the Sept. 17 meeting ran contrary to the building’s reputation for discretion and calm: attendees described the session as contentious, with heated exchanges and a public-voiced sense of urgency to resolve the future of the co-op.

At stake is not only the future of the Pierre’s operations but the fate of tenants who would be displaced if a sale moves forward. Howard Lutnick owns the largest unit—a 12,000-square-foot triplex penthouse purchased in 2017 for $44 million—and, according to several accounts, has not inhabited the space. The Times has described Lutnick as leading a charge to sell the property in a deal that could deliver a substantial windfall to his former real estate firm, a narrative that some residents say unfairly paints him as a boogeyman because of his ties to the Trump administration. Page Six, citing insiders, notes that Lutnick’s role remains contested, with some residents insisting that the plan represents a broader effort to refresh the Pierre for new ownership structure rather than a personal vendetta.

The sale proposal also involves a potential overhaul of the Pierre’s management and physical plant. The building is currently managed by Taj Hotels, and the discussions include a path to upgrade the property in a manner akin to the Waldorf Astoria transition. A key element of the bid is a comprehensive renovation that would address aging elevators and fraying carpets that have been cited by observers, though some insiders contest the extent of the need. A section of the discussion has focused on the cost of ongoing monthly maintenance fees, which some tenants say run into tens of thousands of dollars and add pressure to any decision about changing ownership or management.

Supporters of the sale argue that a large-scale investment could revive a landmark with significant upside for investors and the co-op, while opponents worry about disruption and the risk that a sale would precipitate widespread relocation. The Times’ coverage of the matter has highlighted Lutnick’s role as a leading advocate for selling, while Page Six’s reporting has framed the debate around residents’ concerns and the potential financial upside for long-term holders of co-op shares. A 90-day due-diligence window was cited in discussions, followed by a vote that would require two-thirds approval to proceed with the sale. If approved, the plan could trigger relocations and, for some tenants, the possibility of significant equity gains depending on their shares and the terms of any exit.

The intra-building dispute has drawn notable opposition from Tory Burch, who had previously expanded her Pierre holdings by combining two units in 2001 and who has raised her children at the address. According to Page Six, Burch confronted the board with a sense of urgency and concern that information about the deal had not been sufficiently shared with residents. An insider described her as increasingly animated as the meeting progressed, while other tenants corroborated that she challenged the board’s process and expressed frustration about how decisions were being communicated. The confrontation was not simply a clash of personalities; it reflected a broader fear that a sale would necessitate a mass relocation of residents, some of whom have been at the Pierre for decades.

The dispute has also invoked questions about the building’s condition. While some residents describe the Pierre as deteriorating—citing fraying carpets and service issues—the reality appears more nuanced. An insider noted that while multiple assessments have been conducted as part of due diligence, there have been inconsistent conclusions about the extent of required upgrades. One account suggested that a report asserting dire straits was later rebutted by a separate assessment indicating that the property needs a glow-up rather than a sweeping overhaul. Another insider pointed to the presence of as many as three assessments conducted during the bidding process, underscoring the complexity of evaluating a property with a long history and a high emotional value to its residents.

The sale proposal has drawn interest from a group tied to the Saudi Khashoggi family, with potential involvement from the Dorchester Collection to manage the post-sale property. The path forward could mirror historic restructurings of other luxury icons, including the Waldorf-Astoria, but it would require the cooperation of co-op shareholders, including those who have become vocal critics of the deal. Newmark Group, Lutnick’s former real estate firm, has been involved as an adviser to the Pierre and stands to gain from the deal if it proceeds, adding another layer of potential conflict of interest to an already fraught process. For now, the board’s decision remains pending, with two seats recently vacated and filled by members who have signaled wariness about the sale prospects.

The evolving story has also spotlighted a broader tension between preserving a cultural and social landmark and pursuing a high-stakes financial transaction with the potential to shift ownership and management of a property that has long symbolized Manhattan glamour. Some residents say the building’s appeal lies in its continuity and the sense of community cultivated by generations of families and notable guests; others argue that a modern investment framework could unlock value for shareholders and help fund a needed upgrade that could extend the Pierre’s life as a premier luxury address.

As the process unfolds, observers will be watching how the Pierre’s governance evolves under the pressure of a major external bid, the potential for tenant relocations, and the need to balance financial incentives with the building’s historical and cultural resonance. The Pierre’s leadership has not publicly commented on the specifics of the negotiations announced in recent weeks, but the ongoing discussions reflect a broader trend in which iconic New York properties face transformative opportunities—and contested outcomes—as owners weigh investments, ownership structures, and the long-term viability of preserving landmark status within a rapidly changing cityscape.