Surging Obamacare Prices Could Hit the Hardest Next Year as ACA Subsidies Expire

Analysts warn that ending premium credits at year’s end could trigger steep premium hikes for millions on the ACA marketplace, with broad regional and economic repercussions.

Premiums for ACA marketplace plans could rise sharply next year as federal subsidies expire at the end of the year, a shift that would affect millions already facing higher health costs. Health policy researchers say the end of premium credits could drive costs up dramatically; the Kaiser Family Foundation (KFF) estimates premiums could rise by an average of about 114% for those who lose subsidies. In 2025, 24 million people obtained insurance through the ACA marketplace, with about 22 million of them receiving tax credits to help reduce costs.

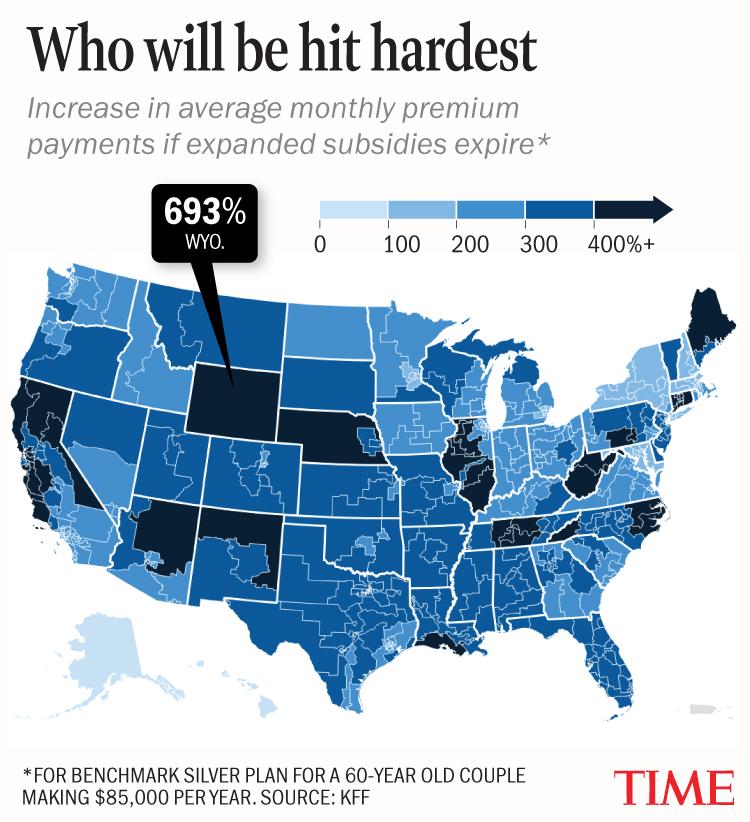

Specific impacts would vary by age, income, and geography. Those just over 400% of the federal poverty level would lose any premium tax credits and face larger increases. In district-by-district projections, a hypothetical 60-year-old couple earning $85,000 would see premium increases ranging widely, with Wyoming showing the largest potential jump (693%), from $602 to $4,777 per month; West Virginia’s first district at 654% (to $4,540); West Virginia’s second district at 599% (to $4,210); Connecticut’s fourth district at 537% (to $3,833); and Illinois’ twelfth district at 535% (to $3,823). Alaska and Hawaii present different baselines because their poverty-level guidelines differ. New York’s community-rated system would produce smaller increases across all districts in the state. In Maryland and New Hampshire, older enrollees making $85,000 could see increases under 200% in every continental district, but even there the monthly payment for the older couple would more than double if subsidies lapse.

Beyond premiums, experts warn that higher costs could cause more people to go uninsured. A separate KFF analysis from August found that subsidy expiration combined with other policy changes could leave about 14.2 million more people uninsured nationwide, with the largest increases in California (about 1.7 million), Florida (1.5 million), Texas (1.4 million), New York (860,000) and Illinois (528,000). The Commonwealth Fund has also warned that states that did not expand Medicaid would bear broader economic costs, with Texas facing the steepest hit: roughly 70,000 jobs lost, about $410 million in tax revenue reduced, and roughly $8.5 billion in lost GDP. Florida would see about 50,000 jobs disappear, more than $300 million in tax revenue, and over $5.5 billion in GDP impact.

The subsidies have been at the center of a months-long budget fight in Congress. Democrats have pressed to extend the tax credits beyond year’s end, tying the issue to spending bills in a stalemate that contributed to the longest government shutdown in U.S. history this fall. A group of eight Democratic senators, many centrists, broke ranks to end the shutdown on the condition that a vote on extending the subsidies would be held in December. But Senate Republicans blocked a competing extension proposal, and with less than three weeks left before year’s end, the extension of subsidies appears virtually certain to end.

Experts say the changes would likely affect coverage rates and access to care, particularly in states that did not expand Medicaid. The outcome underscores the tension between affordability and federal policy, and highlights the challenge of stabilizing health insurance costs on the ACA marketplace in the coming years.