Best Wallet review: Mobile, multi-chain crypto app offers presale access and MPC security but lacks audits

The non-custodial, mobile-first wallet supports more than 60 blockchains and combines discovery, staking and swaps; experts say it shows promise but must be battle-tested.

A new entrant in the crypto wallet market, Best Wallet, is drawing attention for packaging trading, token discovery, presale access, staking and social features into a single mobile app while emphasizing user control through non-custodial key management. A recent review by the New York Post describes the app as ambitious and feature-rich, but notes the product is still earning its reputation in a field where security is validated over time.

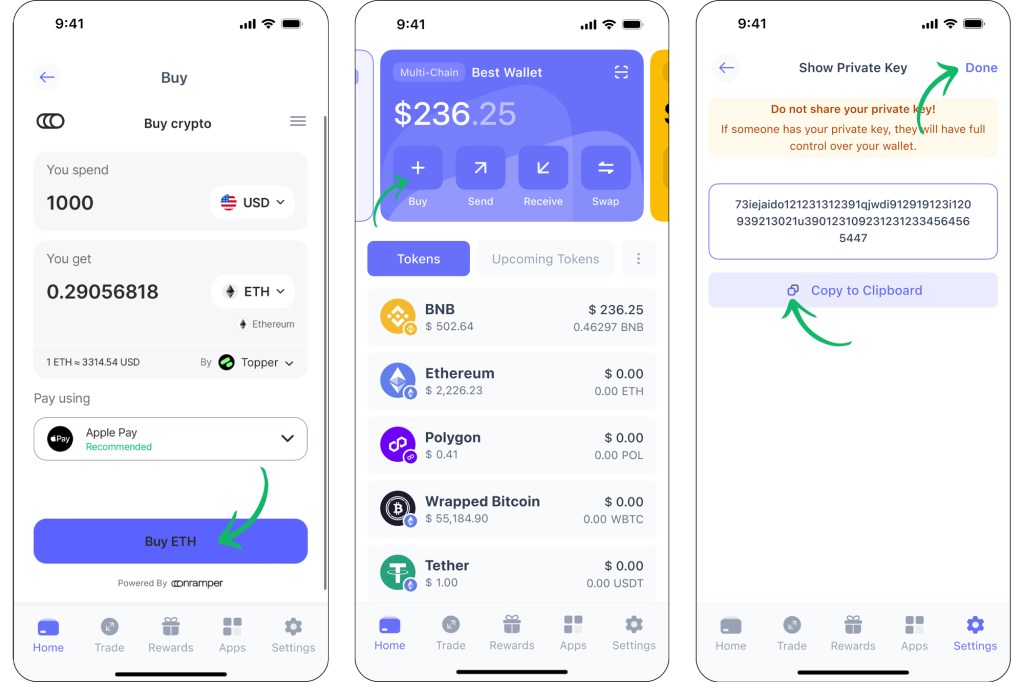

Best Wallet positions itself as a hot wallet that supports more than 60 blockchains and allows users to retain sole control of private keys. The app offers on-device biometric logins, encrypted backups, multi-party computation for key protection and built-in tools for portfolio tracking, token swaps and staking. It also includes a discovery layer that highlights trending tokens and provides access to vetted presales before projects list on exchanges.

The company markets the product as a one-stop solution for everyday DeFi activity: users can follow top-performing wallets, execute cross-chain swaps through integrated decentralized exchanges, stake assets from within the app and monitor real-time market data without leaving the interface. Best Wallet emphasizes a self-custody model, meaning the firm does not hold user funds; private keys are split and encrypted using multi-party computation (MPC) to reduce a single point of failure.

Security is central to the wallet’s pitch, and it has several features typically found in higher-end offerings: encrypted cloud backups that are optional, biometric authentication, and MPC schemes that split key material across secure environments. Those measures are intended to strike a balance between convenience and protection for users who prefer hot-wallet access over offline cold-storage devices such as Ledger or Trezor.

Industry observers said the design choices reflect a growing user demand for wallets that combine trading and discovery tools with privacy. "Safety, whether with Best Wallet or any other, ultimately comes down to the person and what you do with [the wallet]," said Eric Pan, a crypto content creator. "It’s like a house — the safest house is useless if you leave the doors wide open."

Other experts urged caution while acknowledging the product’s potential. "Security is earned through battle-testing," said Harry Sudock, senior vice president at bitcoin mining company CleanSpark. Jack Johnson, director at SEO agency Rhino Rank, said that transparency and independent technical audits remain necessary before Best Wallet can claim parity with long-established services.

Best Wallet diverges from legacy hardware wallets by operating exclusively on mobile devices. The mobile-first design allows for rapid onboarding and feature access, but it also means there is currently no desktop or air-gapped option for users seeking the additional security of an offline device. The company has said it plans further enhancements and lays out a roadmap that includes MEV protection, stop-loss orders and gas token–free transactions, but independent audits and longer uptime records remain on the to-do list.

Reviewers said the user interface is clean and approachable. The onboarding process is short compared with many centralized exchanges: because Best Wallet is non-custodial, it does not require mandatory know-your-customer identity verification. Instead, the app prompts users to create wallets and secure their recovery phrases; the review reiterated the common recommendation to write down and safekeep recovery phrases because they are the only means to restore access if a device is lost.

Best Wallet distinguishes itself with built-in presale access and token discovery. The presale feature curates and vets early-stage token offerings, enabling users to participate in rounds before projects list publicly. That functionality, combined with social tracking that surfaces popular wallets and token sentiment, aims to simplify the workflow for traders and token hunters who currently rely on multiple apps and research channels.

Comparisons with existing wallets underscore the trade-offs users face. Cold-storage devices such as Ledger and Trezor remain the standard recommendation for large, long-term holdings because they keep private keys offline. Browser-based wallets such as MetaMask and mobile-first options like Trust Wallet and Coinbase Wallet retain large user bases due to familiarity and integration with Web3 applications. Best Wallet’s unique selling point is the integration of discovery, presale access and cross-chain tooling within a single mobile application while maintaining non-custodial principles.

Bart Colpa, a longtime crypto user who operates a trading platform in Japan, said he appreciates the comprehensive approach. "It’s the first wallet I’ve seen in a while that feels like it was built for the full journey — not just the start," he said. Still, several reviewers and experts emphasized that time, independent audits and real-world uptime are necessary for a definitive security endorsement.

The New York Post review highlighted both strengths and limitations. Strengths include the all-in-one functionality, minimal onboarding friction, extensive blockchain support and a focus on privacy and self-custody. Limitations cited are the lack of a completed third-party audit, the absence of a desktop client, and caution about recommending hot wallets for very large holdings.

Best Wallet may appeal most to intermediate users, active DeFi participants and investors curious about early-stage tokens who value convenience and control. It is less likely to satisfy Bitcoin maximalists who prioritize air-gapped cold storage or institutions and corporate treasuries that demand audited, enterprise-grade custody solutions.

For users weighing options, reviewers recommend treating Best Wallet as a functional, feature-rich hot wallet rather than a substitute for cold storage of large sums. The app may serve well for trading, staking and presale participation, while high-value assets would be better secured in hardware devices until the wallet accumulates a longer track record and independent security attestations.

Best Wallet’s makers are betting that combining multiple DeFi tools with non-custodial controls will attract users who want fewer apps and more integrated workflows. The approach mirrors a broader trend in crypto tooling toward consolidation of discovery, execution and custody. Whether the wallet achieves wide adoption will depend on the company’s ability to complete independent audits, deliver promised roadmap items and maintain uptime without security incidents.

Until then, the wallet offers a notable option for users who prioritize privacy, optionality and mobile convenience but are willing to accept the inherent trade-offs of hot wallets. Security advocates and seasoned traders interviewed for the review agreed that Best Wallet’s technology and user experience are compelling, but they urged prospective users to limit exposure, practice strong key hygiene and monitor the app’s evolution as independent audits and third-party reviews appear.