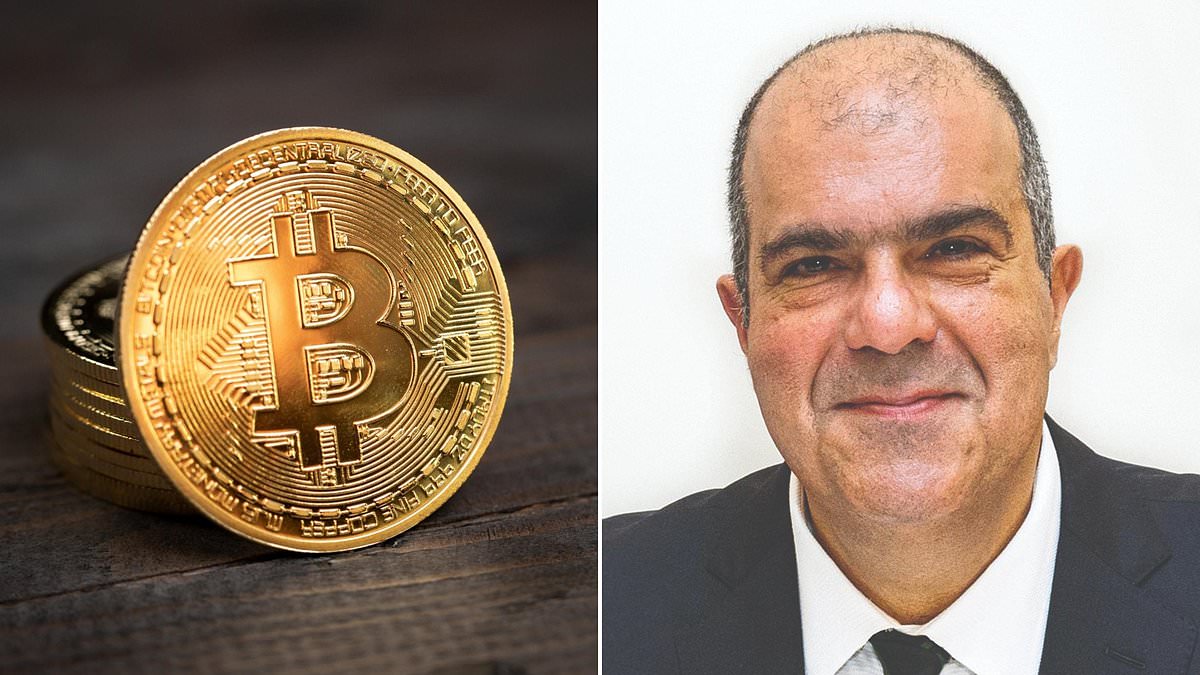

Easygroup launches easybitcoin.app in US, offering bitcoin rewards and interest

Founder Sir Stelios Haji‑Ioannou rolls out mobile crypto app powered by Uphold aiming to simplify buying, holding and earning bitcoin

Easygroup, the company behind the "Easy" brand, has launched a new cryptocurrency mobile application that allows users to buy, hold and sell bitcoin while earning rewards and interest on balances.

The app, called easybitcoin.app, is available in the United States and will expand to the United Kingdom later this year, the company said. The platform is powered by Uphold, an on‑chain finance infrastructure provider, and is marketed as a simpler alternative to crypto platforms it described as designed for sophisticated traders.

Easygroup said users who set up recurring buys — automated crypto purchases that can be scheduled daily, weekly, biweekly or monthly — will receive a one percent welcome bonus on the first $5,000 of recurring purchases each month. Customers can earn up to $50 in bonus rewards for the first three months if they maintain a recurring buy. The company also said bitcoin investors who continue a recurring buy for a three‑month period will be eligible for an additional two percent reward on all bitcoin holdings in the app.

The platform will pay interest on USD balances in bitcoin, with an advertised rate of 4.5 percent on USD balances and a two percent rate for balances under $10, Easygroup said. Bitcoin interest earned on USD balances can be transferred into USD, the firm added.

In the United States, Easygroup said balances will be protected up to $2.5 million under the Federal Deposit Insurance Corporation. The company noted that in the United Kingdom, the Financial Services Compensation Scheme covers up to £85,000 of assets but said it is currently unclear whether FSCS protection will apply to cash held on the platform when the UK launch occurs.

"For too long, investing in bitcoin has felt like an exclusive club, out of reach for the general public with very high transaction costs," said Sir Stelios Haji‑Ioannou, founder of Easygroup. "With the easybitcoin.app, we're aiming to change that and provide simple access via your mobile phone, great value and a focus on earning bitcoin rewards whether you're buying or simply holding bitcoin."

Simon McLoughlin, chief executive of Uphold, said the reward structure is intended to attract people who are aware of bitcoin but have not yet engaged with it. "Beyond appealing to the converted, receiving rewards in bitcoin on USD balances is the perfect draw for that huge segment of the population that has become aware of bitcoin, but has yet to take the plunge," McLoughlin said.

Easygroup released research alongside the launch that said 49 percent of Americans find bitcoin difficult to buy, hold and sell because of complex trading platforms. The company also reported that 88 percent of Americans surveyed trust bitcoin to grow their money over the next decade. In the United Kingdom, Easygroup said more than seven million people hold some form of cryptocurrency, that bitcoin ranks among the top three investment choices for 39 percent of those surveyed and that 57 percent would rather invest in bitcoin than put money into traditional savings accounts.

Easygroup licensed the "Easy" brand across a range of businesses after founding airline EasyJet in 1998; Haji‑Ioannou retains a stake in EasyJet. The new app represents the company's first direct consumer product positioned expressly around cryptocurrency, arriving at a time when mainstream financial services firms and start‑ups continue to expand retail access to digital assets.

Regulatory and consumer protections for crypto products vary by jurisdiction, and questions remain about how traditional deposit insurance frameworks apply to on‑chain and custodial crypto services. Easygroup said it would provide more details about the UK launch and any applicable protections closer to the rollout.

The company framed the effort as both technological and financial inclusion: "This isn't just about technology; it's about financial empowerment and making bitcoin a practical investment option for all," Haji‑Ioannou said.