New app Chest channels cashback into pensions to target Gen Z shortfall

Chest, launched this week, offers a SIPP that diverts retail cashback into retirement funds and adds gamified savings tools aimed at savers under 45

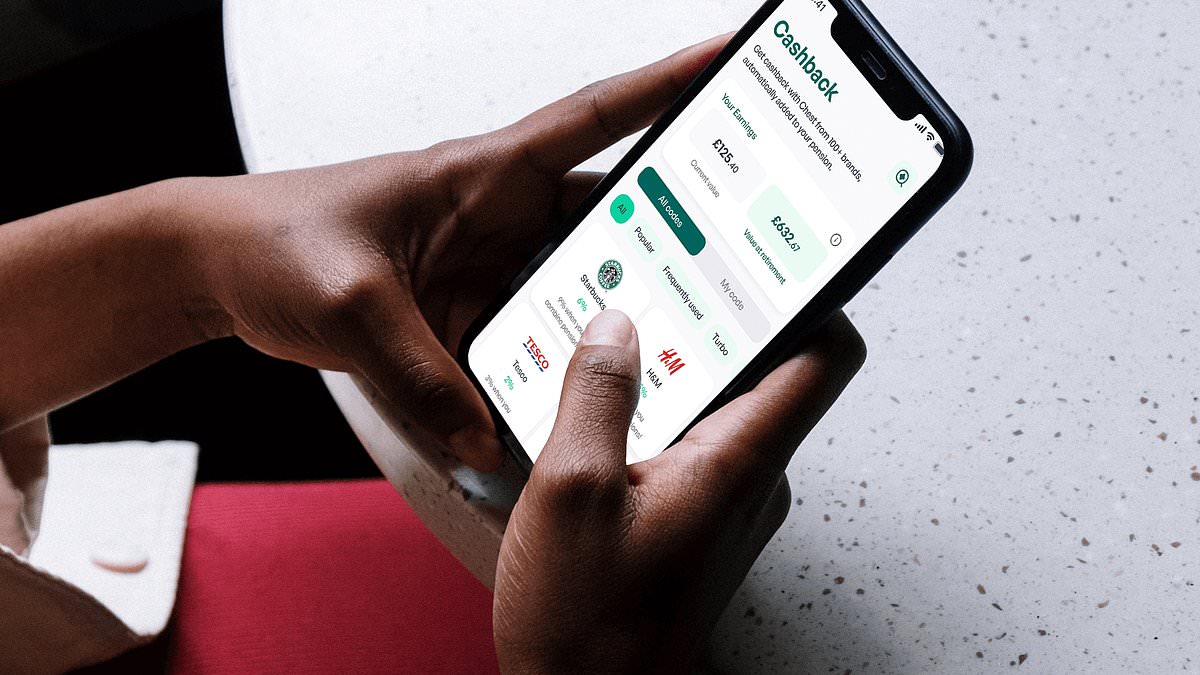

A new app called Chest launched this week with a proposal to turn everyday shopping rewards into pension contributions, offering a self-invested personal pension, or SIPP, that automatically funnels cashback into users' retirement pots.

Chest’s founders say the platform is designed to appeal to younger adults who already use cashback and rewards schemes, allowing small sums earned from purchases to be invested for the long term. The company is targeting people under 45 but allows older savers to join.

Users who sign up to Chest buy e-gift cards through the platform and then make purchases with those cards; cashback rates on more than 120 retailers range between about 1% and 12% depending on the merchant. Chest’s co-founder Ali Adam said grocery vendors typically offer three to five percent cashback, larger marketplaces such as Amazon sit near one percent, and some fashion and travel companies provide higher rates.

Chest will place cashback payments directly into a user’s SIPP, with typical monthly sums described by the founders as small — often a few pounds — but the founders argue that compounded growth over decades can meaningfully increase retirement savings. Chest estimates that £15 per month in cashback is achievable for many users; independent industry data cited in company materials suggests that between £6 and £40 a month is already being earned by younger people using cashback platforms.

"We've found that young people do care about saving for retirement, despite not being able to afford to, or finding it confusing," Adam, 34, told This is Money. "The whole ethos around what we're doing at Chest is micro-savings made early, compounding to something that can be quite sizeable in the future and really support people with the shortfall."

Jason Murphy, Chest's other co-founder and a former PwC employee, said the idea grew from the thought: "What if you could take existing transactions and leverage those for the benefit of further rewards that might not otherwise exist." The founders said Cashback income is intended to supplement rather than replace traditional pension contributions.

Chest offers six investment options within the SIPP: three standard default funds and three funds marketed as responsible investing options. The platform’s primary fund is described as an equity-focused FTSE All-World Index tracker. Chest also plans multi-asset funds with varied equity allocations; the founders say asset allocation within those multi-asset funds will be active but that all six options are implemented through passive underlying investments.

The firm is an appointed representative of a larger, FCA-authorised asset manager, a structure that allows smaller firms to operate under the regulatory permissions of a principal firm rather than holding direct FCA authorisation themselves. Chest says its fees are competitive with other investment platforms and that customers can transfer existing SIPPs and previous workplace pensions into the app.

The app includes gamified features designed to encourage saving habits, such as round-ups that invest spare change, "no-spend" challenges that automatically set aside predetermined amounts on days without spending, and a "Chest score" metric intended to show users how they compare with peers and whether they are on track to meet targets. The founders say the scoring tool aims to counteract present-bias — the tendency to prioritise current consumption over future needs.

Industry context underpins the product launch. UK data cited by Chest and national outlets show many younger adults are not saving adequately for retirement: Hargreaves Lansdown has reported that about one-third of Generation Z and millennials are on track with pension saving, and Standard Life has estimated that delaying pension contributions while young can leave gaps of tens of thousands of pounds in later life.

Chest also points to internal data that 72% of the two youngest adult generations already use cashback or loyalty rewards monthly, arguing the consumer habit can be redirected to retirement saving. The founders emphasise that the sums deposited via cashback will typically be modest, but they highlight the potential for compound growth when saving starts early.

The launch arrives amid a wider shift in fintech toward micro-saving and behavioural nudges aimed at closing long-term savings shortfalls. Chest’s model relies on retailer partnerships that produce cashback, user adoption of the e-gift card workflow it requires, and the ability to retain customers as their primary or supplementary pension provider.

Chest’s founders said they hope the app will become the principal pension platform for many users in their target demographic while helping to address a perceived savings gap among younger adults. Prospective users should consider how cashback-driven contributions interact with annual pension limits and personal financial circumstances before transferring existing pensions or making changes to contribution strategies.

Chest’s launch adds to a growing market of app-based pension tools that blend everyday financial activity with long-term investing, offering another route for younger savers to build retirement funds without substantially altering daily spending patterns.