Trump's $100,000 H-1B fee shocks tech world; experts warn of broader US impact

White House clarifies the hike targets new applicants only and would be a one-off, but industry analysts say the policy could reverberate through Indian IT, US universities and startups.

The White House on Friday stunned the tech world by announcing an up to 50-fold increase in the cost of skilled-worker permits, effectively hiking the price of a new H-1B visa to $100,000. By Saturday, officials sought to calm the market, clarifying that the fee would apply only to new applicants and would be a one-off. Yet the episode has injected long-simmering questions about talent pipelines, sponsorship norms and the fate of a visa program that many say underpins American innovation and global competitiveness.

The immediate response was chaos: Silicon Valley firms urged staff not to travel outside the United States, overseas workers rushed to secure flights, and immigration lawyers raced to interpret the order. While the White House message emphasized a narrow scope for the new fee, the move put a spotlight on the broader H-1B framework and the sectors that depend on it most—the tech industry, the healthcare professions, universities and startups.

For three decades, the H-1B program has been a vehicle of aspiration for millions of Indians and a key source of global talent for American labs, classrooms, hospitals and startups. It reshaped both countries: in India, the visa route helped propel small-town coders into middle-class incomes and gave rise to entire industries from airlines to real estate that catered to a globe-trotting workforce. In the United States, it supplied a steady stream of engineers, researchers and clinicians, many of whom now help run some of the world’s largest tech firms and top healthcare systems.

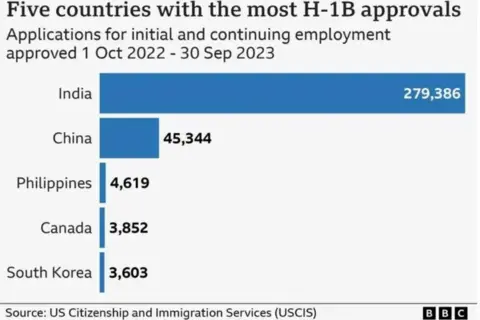

One measure of the stakes: Indians account for roughly 70% of H-1B recipients in recent years, with China the second-largest source at around 12%. In the tech sector, the share of computer-related H-1B holders who are Indian nationals has hovered well above the national average in multiple years. The dynamic is underscored by U.S. data requests and industry reports that show how deeply Indian professionals have penetrated core tech roles and biomedical research. In medicine, the H-1B program also supports a substantial share of international medical graduates who work in U.S. hospitals and clinics; in 2023, more than 8,200 H-1Bs were approved to work in general medicine and surgical hospitals, and Indian doctors make up a sizable chunk of the international medical workforce.

Pay data from 2023 also colors the debate. The median salary for new H-1B employees was about $94,000, compared with roughly $129,000 for those already in the system. Because the $100,000 fee targets new hires, many young specialists—who may still be working to reach their peak earning years—could find the financial hurdle insurmountable, experts say. The policy thus risks creating bottlenecks in talent entry rather than an immediate disruption to the current workforce. Gil Guerra, an immigration policy analyst at the Niskanen Center, noted that the fee could prompt longer-term shortages as employers rethink sponsorship and hiring timelines.

The ripple effects could spread well beyond visa sponsorship. Indian outsourcing giants have long prepared for shifts in visa policy by building local workforces, expanding offshore delivery centers and broadening client bases to reduce dependence on onshore sponsorship. Pew Research data show that Indians still account for about 70% of H-1B beneficiaries, while the number of top employers tied to India has declined in recent years, suggesting a broader reconfiguration of sponsorship networks. The broader economy also stands to feel the impact: U.S. hospitals could face doctor shortages, universities could struggle to attract STEM students, and startups without deep-pocket lobbying power may be hit hardest. David Bier, director of immigration studies at the Cato Institute, warned that the policy could force U.S. companies to radically change hiring policies and offshore more work, potentially hampering domestic innovation and competitiveness if large players manage to carve out exemptions.

The policy has already prompted a chorus of concern about the health of the U.S. innovation ecosystem. The sector’s dependence on highly skilled foreign workers remains a sensitive political and economic question, particularly as the U.S. economy seeks to maintain leadership in AI, biotech and engineering. The divide over whether the United States should tighten or expand access to skilled labor underpins a broader debate about how to balance domestic wage concerns with the need to attract global talent, fund research, and sustain startups.

Analysts caution that the immediate effects may be uneven and evolve as the rulebook is litigated and implemented. Nasscom, the Indian IT industry association, said the visa fee hike could disrupt business continuity for certain onshore projects, with clients potentially repricing contracts or delaying projects until legal uncertainties are cleared. Firms may pivot toward offshore delivery, remote contracting and gig-based staffing models to manage higher sponsorship costs. Aditya Narayan Mishra of CIEL HR, a leading staffing firm, suggested that employers could pass some of the cost to U.S. clients, further reshaping project economics in a tight labor market.

The impact on Indian students and universities could come into sharper relief in the coming year. Sudhanshu Kaushik, founder of the North American Association of Indian Students, represented at 25,000 members across 120 universities, said the timing—from the September intake onward—felt like a direct blow. For many families, the new fee compounds sunk costs already paid for admission and visa processing, potentially deterring future students from pursuing study in the United States and prompting a shift toward countries offering clearer paths to permanent residency. Kaushik emphasized that the policy could reduce U.S. college enrollment by Indian students, which already represents roughly a quarter of international students.

The broader question is whether the United States will continue to rely on international talent to fuel innovation, clinical care and startup culture. Some experts anticipate that the policy will take time to play out, with negative consequences that emerge gradually rather than immediately. Guerra suggested that even if some heavy H-1B users obtain exemptions, a broader shift away from sponsorship would undermine the program’s purpose and could deter a generation of skilled workers from pursuing opportunities in the United States.

The U.S. economy benefits from international workers in tangible ways. H-1B holders and their families contribute roughly $86 billion annually to the U.S. economy, including about $24 billion in federal payroll taxes and $11 billion in state and local taxes, and their presence supports innovation, patient care, and university research. How companies adapt to the new fee policy—and how policy makers adjust in response to potential legal challenges—will shape whether the United States retains its edge in technology and healthcare or cedes ground to more welcoming economies.

The episode is not simply a tax on foreign workers; it is a stress test for hiring models, wage dynamics and the ability of U.S. institutions to attract global talent. With the legal battles looming and the business implications still taking shape, industry observers say the next several months will be defining for the future of skilled immigration in technology and AI-enabled sectors.

As policymakers and industry leaders watch the fallout, the debate remains about how to calibrate a system that some view as essential to American leadership in AI, robotics and biotech, while others insist that protections for American workers must come first. The coming weeks are expected to bring more precise guidance on exemptions, enforcement, and the path forward for both the onshore and offshore components of the U.S. talent pipeline. In the meantime, companies that rely on highly skilled workers will be watching closely several fronts: sponsorship timelines and costs, the stability of the labor market for STEM roles, and the readiness of universities and hospitals to adapt to a potentially more constrained supply of international talent.

The discussion will extend beyond the technology sector. Indian doctors and researchers, engineers and students have built bridges into U.S. institutions that touch nearly every corner of American life. A shift in visa policy could alter not only who comes to work in the United States, but also who studies there, who mentors American students, and who drives innovations at the cutting edge of AI and other technologies. As employers weigh their staffing strategies, government policy makers face a difficult balancing act between protecting domestic wages and sustaining an open, globally competitive innovation ecosystem.

The uncertainty around the policy underscores the need for clear, durable rules that can withstand legal scrutiny while supporting the talent pipelines that power American industry. Whether the H-1B program evolves into a more restrictive gatekeeper or emerges with reforms that preserve a pathway for skilled workers remains an open, heavily debated question. As the saga continues, the tech sector, healthcare providers and higher education systems will be watching closely how the United States negotiates talent, immigration and economic growth in an era of rapid digital transformation.