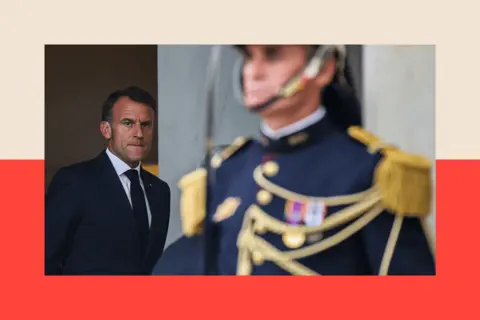

France at risk of becoming the new sick man of Europe

Debt burden, political paralysis and street protests test Macron's ability to steer a nation in a time of global volatility

France faces a perilous political and economic moment as it grapples with a rapid turnover of leadership, a fragmented parliament, and a street-protest cadence that has unsettled markets and voters alike. In less than two years, President Emmanuel Macron has seen five prime ministers and a snap parliamentary election in July 2024 that produced a hung assembly. The result is a budget process that cannot easily secure a majority, even as France confronts near-record debt service costs and a broader sense that its once-steady fiscal machinery may be fraying at the edges. The immediate test is whether the new prime minister, Sébastien Lecornu, can stitch together a governing coalition sufficient to table and pass a budget by mid-October, with year-end passage the ultimate aim.

The state of France’s public finances has become a focal point of the crisis. The cost of servicing national debt this year is estimated at €67 billion, a figure that now consumes more money than all government departments except education and defense. Forecasts suggest the burden will continue to rise, reaching about €100 billion a year by the end of the decade. The ratings downgrade of French debt by Fitch last week added to the sense of fragility, potentially raising borrowing costs and making rescue options, including IMF support or ECB intervention, more plausible in the global environment of upheaval and rising populism. The debt dynamics sit atop a wider backdrop of international turmoil: war in Europe, a sense of American disengagement, and the ascent of populist movements that complicate traditional policy responses.

Unions and left-wing groups have mobilized against the government’s budget plans. A national day of protest branded by some as a continuation of Bloquons Tout (Let’s Block Everything) underscored an opposition that argues the state must reframe its approach to spending and debt. The larger demonstrations that followed — organized by unions and left-wing parties — drew hundreds of thousands into streets, challenging a government that insists it can steer the country through a period of austerity without sacrificing social protections. Veteran commentator Nicolas Baverez warned that France risks “paralysis, impotence and debt” at a moment when sovereignty for France and Europe is at stake. Macron has insisted he remains committed to a path forward, despite the ominous fiscal signals and political volatility.

Emmanuel Macron’s management of the crisis has become a test of political stamina and strategic compromise. The dissolution of the National Assembly in mid-2024 did not deliver a stronger governing coalition; instead, it produced a three-way split among centrists, the left, and the far right. The centrist bloc, led by the new prime minister, faced an immediate constraint: any budget would require concessions to both the left and the right, a dynamic that threatens to dilute policy while extending the political calendar. François Bayrou, a veteran centrist, pushed a €44 billion cut in the 2026 budget as a means to stabilize debt, but his plan provoked a confidence vote in which left- and far-right MPs united to bring him down. The result was a prime ministership that faltered and a president who has sought to recalibrate his approach.

Sébastien Lecornu, a 39-year-old who rose from within Macron’s inner circle, was named prime minister in part for his perceived loyalty and for a perception that he would pursue a stable, non-ego-driven approach. The president said he believed an agreement between political forces was possible while respecting their convictions. The rhetorical frame suggests a pivot: Macron would steer not by a linear, center-right consensus alone but by attempting to broker a deal that also courts the left, particularly the Socialist Party, whose support would be essential to crossing the budget finish line. As one economist who has advised Macron put it, “Macron and Lecornu are essentially one.” Yet the practical challenge remains: any budget concessions to the left risk alienating pro-business conservatives, while appeasement of the right could provoke a backlash from labor groups and the left. And the political timing compounds the problem: municipal elections are due in March, followed by a presidential contest in 2027. The National Rally on the right and France Unbowed on the left are poised to challenge any sign of compromise as treason, complicating the calculation for any centrist accord.

To move forward, Lecornu must present a budget by mid-October and secure passage by year’s end. The arithmetic is delicate: his centrists require support from both the Republicans to the right and the Socialists to the left. Yet any concession to one side could provoke walkouts from the other. The Socialists have demanded a lower debt target and policies such as a tax on ultra-rich entrepreneurs and the roll-back of Macron’s 2023 pension reform (which raised the retirement age to 64). The Republicans, meanwhile, have warned they will oppose measures that threaten business competitiveness or require higher taxes. France’s main employers’ union, MEDEF, has signaled it will stage its own demonstrations if the budget relies on higher taxes. The looming reality is that, even if a fragile deal is brokered, the resulting budget may be a pared-down version that calms markets without fully addressing the structural questions that have underpinned the crisis.

A central question is whether the market and international observers will interpret any interim settlement as a viable pathway or a sign of enduring gridlock. The specter of an IMF loan or ongoing ECB involvement looms not merely as a theoretical contingency but as a reflection of the deepening concerns about France’s fiscal trajectory in a period of global economic flux. The strategic risk for Macron and Lecornu is that ongoing political paralysis curtails the government’s ability to enact reforms that could restore confidence in France’s long-term trajectory, while the near-term costs of delay accumulate in debt service and social tensions.

The timing within France’s broader political calendar amplifies the pressure. The current governance impasse sits alongside a broader global context in which European partners are watching with heightened sensitivity toward debt resilience and reform courage. Some observers argue that France’s fundamental economic strengths — its deep capital markets, advanced infrastructure, and institutional resilience — offer a path through the current upheaval. FormerLR president Jean-François Copé has argued that French fundamentals remain solid, noting that unemployment remains high by UK standards but not disastrously so and that business creation and growth have outpaced some peers. “Our level of unemployment is traditionally higher than the UK's but nothing disastrous,” Copé said, offering a tempered counterpoint to more dire projections.

Yet other voices warn that the current moment could be a tipping point. Philippe Dessertine, director of the Institute of High Finance in Paris, warned that the IMF intervention scenario cannot be dismissed. “We can’t just wave away the hypothesis of IMF intervention, the way the politicians do. It is like we are on a dyke. It seems solid enough. Everyone is standing on it, and they keep telling us it's solid. But underneath the sea is eating away, until one day it all suddenly collapses,” he said. Françoise Fressoz of Le Monde noted that the era of coping through public spending and social peace may be ending, with implications for both left and right alike: “We have all become totally addicted to public spending. It’s been the method used by every government for half a century to put out the fires of discontent and buy social peace. Everyone can sense now that this system has run its course.”

The crisis is rarely simple to categorize. Jerome Fourquet, a pollster, likened the moment to “an incomprehensible play being acted out in front of an empty theatre,” underscoring a public sense that debt and sovereignty are at stake even as the population questions who should bear the burden and how. Macron came to power in 2017 with an explicit aim to bridge political divisions and modernize the economy; some observers see the current juncture as a test of whether that promise can still be fulfilled. Nicolas Baverez, a veteran political thinker, has been blunt about the stakes, arguing that Macron bears substantial responsibility for a national “shipwreck” that could embolden extreme forces if unchecked. Others remain more optimistic about France’s underlying capacities. The question now is whether Lecornu’s leadership can translate that optimism into a credible, lasting policy framework that passes muster with lawmakers and markets alike.

As France navigates this critical period, analysts emphasize that the trajectory will hinge on political economy more than rhetoric: whether France can reshape its fiscal path, secure a durable cross-partisan budget, and preserve the credibility of its institutions in a world where Europe’s stability itself is increasingly in question. If the government can broker a credible plan that stabilizes debt dynamics without triggering a broader social backlash, there is a path to resilience. If not, the country risks a protracted stalemate, renewed debt costs, and the unsettling possibility of a political realignment whose outcome could reverberate beyond France’s borders. The coming months will reveal which scenario is closer to reality.

The broader implications for Europe and the global economy will depend on how France balances the competing demands of debt reduction, growth, and social protection. For now, the government faces a stark choice: push through a budget that keeps the state solvent, or risk an escalation in markets and social unrest that could shape the political landscape for years to come. In a moment when every euro counts and every vote matters, France’s future hangs in the balance between bold reform and political compromise. The historical record suggests the country has weathered storms before; the question is whether it can do so again in a way that preserves its standing in Europe and secures a stable path forward for its citizens.

The political calculus remains unsettled as Lecornu and Macron attempt to translate intent into a workable budget. If a pragmatic accord emerges, it will require concessions that satisfy a broad spectrum of political actors without triggering open fracture on the right or the left. If not, the trajectory suggests a return to instability, with the possibility of further elections and a renewed push by nationalist and populist currents. In either case, France’s near-term debt trajectory, the resilience of its institutions, and its ability to maintain social cohesion will be closely watched by markets and partners across Europe.