Oil pressure campaign tests Maduro regime as U.S. sanctions tighten

Sanctions and a tanker seizure threaten Venezuela’s main revenue source, highlighting oil as the regime’s critical vulnerability amid broader regional pressure.

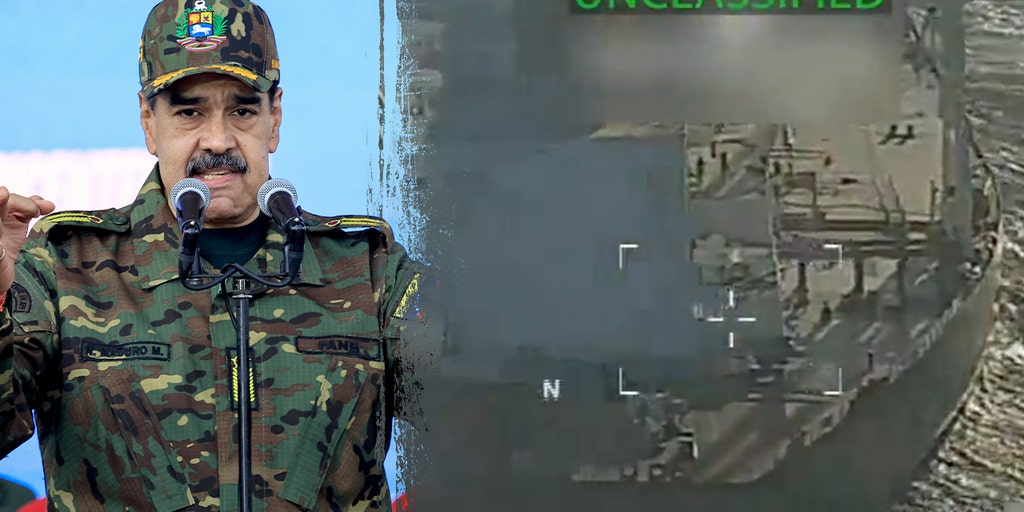

The Trump administration has intensified pressure on Nicolás Maduro by seizing a Venezuelan crude oil tanker and enforcing a blockade on sanctioned vessels, a move aimed at choking the regime’s main revenue stream and probing its ability to endure under oil-focused pressure.

The action comes as Washington seeks to weaken Maduro’s hold on power through紧 tighter economic and diplomatic pressure after years of sanctions. U.S. officials said the seized vessel was headed for Cuba, but analysts say the cargo likely would have flowed to Asia, with China accounting for a substantial share of Venezuela’s crude shipments. The seizure underscores a coordinated effort to disrupt the mechanics of Venezuela’s oil trade and the cash that sustains the regime.

According to Reuters, up to 11 million barrels of Venezuelan crude are currently stranded aboard 39 tankers anchored offshore. Jorge Jraissati, president of the Economic Inclusion Group, said the move fundamentally changes the economics of Venezuela’s oil exports. “That oil is neither sold nor paid for. Until those cargoes move, they generate no cash flow for PDVSA and deepen Maduro’s liquidity strain.” PDVSA is Venezuela’s state-run oil company, and oil has long dominated the country’s economy: it accounts for more than 80% of exports and roughly 90% of government revenue, leaving the nation acutely vulnerable when shipments stall. “After years of economic collapse as a result of Venezuela’s socialist policies, virtually all other sectors of the economy are bankrupted,” Jraissati noted.

The recent actions have also sent oil prices and contracting terms into a tighter arc. Experts say the crackdown is reshaping the economics of oil exports from Venezuela, forcing buyers to renegotiate spot contracts and seek insurance under new terms as the risk profile of the cargo rises. The country’s lack of reliable payment channels and the arduous task of moving crude through a more scrutinized network have compounded the challenge for Maduro’s government. As the blockade tightens, buyers may demand deeper discounts or longer payment delays, compressing PDVSA’s cash flow and increasing pressure on security forces who rely on state funding.

The regime’s reliance on oil revenue is so acute that it has become a central axis of international concern about Venezuela’s stability. One analyst noted that with oil accounting for the bulk of government income, any sustained disruption has the potential to ripple through public spending, social programs and the ability of security forces to maintain backing for Maduro. “Oil pressure alone is not enough. Diplomatic pressure alone is not enough. But when all of these are combined, there is a much greater possibility of Maduro actually falling,” said an analyst involved in the study of Venezuela’s sanctions regime.

In the broader regional context, experts say Maduro has survived sanctions and diplomatic isolation before by shifting to illicit revenue streams and by maintaining patronage networks that keep loyalty within the security apparatus. Still, the current policy mix—sanctions, seizures and a broader attempt to isolate Venezuela politically—represents an unprecedented push that aims to strangle the state’s primary economic lifeline. “Regimes like Maduro’s display little concern about the impact of sanctions on their own people, and when traditional sources of income dry up, they seek other lifelines,” said Cale Brown, chair of Polaris National Security and a former State Department spokesperson.

Economists and human-rights advocates caution that even a sustained oil squeeze will not instantly topple Maduro, but the combination of measures could increase the regime’s vulnerability by eroding cash flow, squeezing wartime financing for security forces and undermining patronage networks that have long propped up the regime. As the sanctions bite, analysts expect new negotiations and adjustments in oil sales to unfold, potentially with a deteriorating cash position for PDVSA and a broader willingness by buyers to seek alternative suppliers or terms.

The oil crackdown comes amid a humanitarian backdrop in Venezuela, where poverty remains widespread and emigration has reshaped the country’s demographics. Analysts note that more than eight million people have left the country in recent years, and a large share of the population lives in poverty, with many households earning well below the income needed for basic necessities. While experts insist that oil revenue belongs to the Venezuelan people, not Maduro or his inner circle, the regime has long leveraged the oil sector to sustain governance and security structures at the expense of broader economic diversification.

As the international community weighs next steps, the strategic aim remains clear: to cut off cash flow that sustains the regime and to pressure Maduro toward a political settlement. Washington frames Venezuela as a focal point for regional security concerns, including narcotics and other illicit activities linked to the regime. While some European allies have cautioned that aggressive moves could complicate regional stability, U.S. officials argue that a tighter clamp on oil exports is a necessary component of a broader strategy to restore democratic norms.

In the weeks ahead, observers will watch whether this wave of enforcement actions translates into tangible liquidity shortages for PDVSA, new terms demanded by buyers, and a shift in how Venezuela’s patronage networks operate under pressure. The balance between sanctions pressure and potential escalation remains a critical question for policymakers, regional partners, and the Venezuelan public.

Looking forward, analysts say the trajectory will hinge on whether the U.S.-led pressure can fragment key support structures within Venezuela’s security and political apparatus while limiting the regime’s access to international shipping and insurance networks. If the current approach persists, Maduro could face a deterioration in liquidity that makes it harder to sustain the broad power apparatus relied on to govern. But those same analysts caution that, historically, the regime has endured economic shocks by adapting revenue streams and tightening internal command and control—dynamic that will complicate any simple path to replacement.

In short, the oil-based economy remains Maduro’s most consequential vulnerability. If the current strategy continues to erode the cash flows that underwrite state power, it could tilt the balance toward a political settlement or a leadership crisis. But the timeline and outcome remain uncertain, dependent on global market responses, the resilience of PDVSA’s trading networks, and how other countries calibrate their engagement with Caracas amid competing strategic priorities.