U.S. escalates oil-pressure campaign against Maduro with tanker seizure and sanctions on Venezuelan oil

The move targets Venezuela's oil trade as sanctions tighten and regional stability faces new tests amid an oil-reliant economy and international pressure.

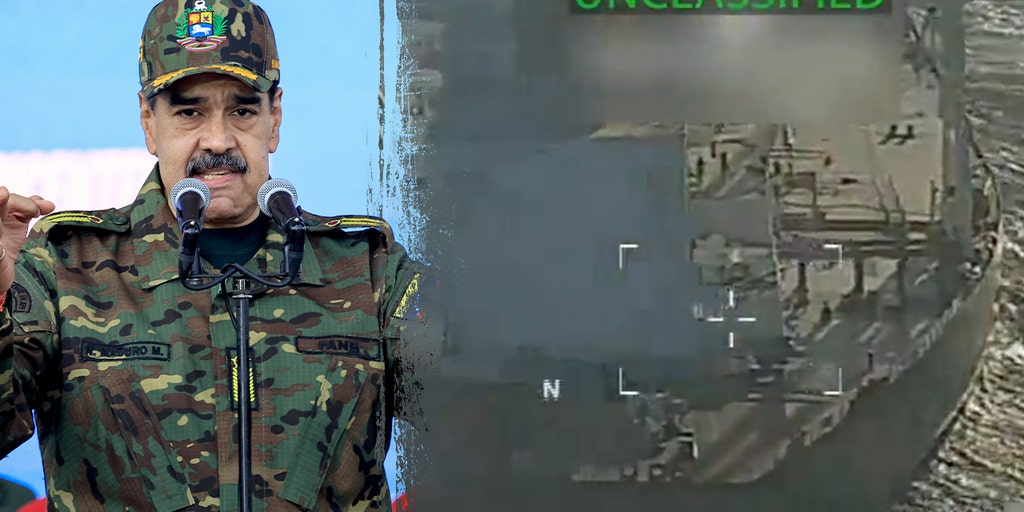

The Trump administration escalated its oil-pressure campaign against Nicolás Maduro's government by ordering a total blockade of sanctioned oil tankers entering and leaving Venezuela and announcing the seizure of a Venezuelan crude tanker, actions officials say are aimed at crippling the regime's main cash source. U.S. officials said the seized vessel was headed for Cuba, though some analysts say China is the more likely destination, reflecting Venezuela’s deep dependence on foreign buyers for crude sales. The move signals a sharper effort to squeeze the regime’s liquidity as Washington, and its partners, seek to undermine Maduro's ability to sustain security forces, patronage networks and political control.

Up to 11 million barrels of Venezuelan crude are stranded aboard 39 tankers anchored offshore, according to Reuters, creating a bottleneck that reduces immediate cash flow for PDVSA, the state-owned oil company. The disruption comes after years of sanctions that largely targeted the oil sector but allowed some crude moves through intermediaries and opaque networks. Jorge Jraissati, president of the Economic Inclusion Group, said the new actions “fundamentally change the economics of Venezuela’s oil exports.” “That oil is neither sold nor paid for,” he added, until cargoes can be moved. Jraissati noted that roughly 60% of Venezuela’s oil exports have traditionally flowed toward China, making the China market particularly sensitive to any disruption. He also pointed out that Venezuela’s heavy crude now trades at discounts of as much as $21 per barrel below Brent, squeezing potential revenue for the regime. The industry and the regime have long relied on a so‑called “shadow” or “dark” fleet—ships that mask ownership and reflag frequently—to move cargoes around sanctions, but insurers and ports have grown wary of vessels linked to PDVSA. ![Oil tanker anchored offshore near Venezuela] (https://a57.foxnews.com/static.foxnews.com/foxnews.com/content/uploads/2025/12/1200/675/oil-tanker.jpg?ve=1&tl=1 " ")

The seizure and broader blockade are reshaping Venezuela’s oil trade in real time. The combination of a tightened physical blockade and increased risk for tanker owners heightens the cost of sales and complicates spot contracts, analysts say. “Exports will not stop, but the conditions under which they are sold will deteriorate sharply. It will weaken Maduro’s cash flow,” Jraissati said in assessing the immediate commercial impact. The loss of revenue comes as the regime seeks funds to pay security forces, keep patronage networks intact and fund governance operations at a time when the broader economy remains in a deep crisis.

In recent years, Venezuela has used a sprawling, opaque network of intermediaries to move crude despite sanctions, but the tightening enforcement is narrowing those channels. The blockades come as U.S. and allied officials have argued that the regime’s survival depends on oil, and that cutting that lifeline could precipitate broader political change. “The oil is essential to the Maduro regime’s ability to pay generals and cartel partners and to stay in power,” said Melissa Ford Maldonado, director of the Western Hemisphere Initiative at the America First Policy Institute. She added that the administration’s measures are designed to hit the core revenue streams that sustain Maduro’s authority. “One thing is clear: the Maduro regime can’t sustain itself without oil revenue,” she said. “What we’re seeing now with President Trump’s order for a total blockade of all sanctioned oil tankers entering and leaving Venezuela is a direct hit against Maduro’s revenue streams.” ![Oil refinery in Venezuela] (https://a57.foxnews.com/static.foxnews.com/foxnews.com/content/uploads/2025/12/1200/675/oil-refinery-venezuela.png?ve=1&tl=1 " ")

Maduro’s regime has weathered sanctions, protests and diplomatic isolation before, but analysts say the present oil crackdown targets the regime’s most fragile financial pillar. Even with the new restrictions, some observers caution that oil pressure alone is unlikely to topple Maduro. Noting that sanctions can drive regimes to seek alternate illicit revenue streams, Cale Brown, chair of Polaris National Security and a former State Department spokesperson, said: “Regimes like Maduro’s display little concern about the impact of sanctions on their own people, and when traditional sources of income dry up, they seek other lifelines.” He argued that the broader U.S. strategy—combining oil pressure with diplomatic isolation and anti-trafficking measures—addresses multiple fronts, including security and influence in the region.

The human cost of the crisis remains severe. Venezuela’s economy has long been oil dependent, with petroleum exports accounting for more than 80% of total exports and roughly 90% of government revenue. As the oil trade tightens, the country’s already battered population faces escalating hardship: estimates from researchers and policy groups suggest about 80% live in poverty, roughly half in extreme poverty, and more than 8 million people have left the country in recent years. The latest squeeze on cash flow complicates the government’s ability to fund services and maintain public support, and it raises questions about the trajectory of any political transition in Caracas as regional actors watch for potential shifts in influence.

European allies have expressed concern that a sharper escalation in Venezuela could destabilize the Caribbean region and complicate efforts to broker a political path forward. While Western powers argue that Maduro’s regime remains illegitimate in the face of a contested 2024 vote and ongoing economic collapse, they also worry that a rapid escalation without a clear political process could deepen regional tensions and push migration, crime and illicit finance to new levels. Officials in Madrid, Paris and Berlin, among others, have urged caution and stressed the need for a coordinated strategy that reinforces international law while encouraging negotiations toward a lawful, democratic solution.

Analysts caution that the complex network of sanctions, seizures and diplomatic pressure has no single guaranteed outcome. Some say the oil pump still runs for Maduro, albeit at a slower pace, while others insist that a sustained, multi-pronged approach increases the odds of weakening the regime’s grip on power. “This needs to be seen as a combination of actions,” Brown said. “Oil pressure alone is not enough. Diplomatic pressure alone is not enough. But when all of these are combined, there is a much greater possibility of Maduro actually falling.” The evolving scene in Caracas and the global response will be watched closely in the weeks ahead as the regime adapts to tighter controls and manufacturers, traders, and lenders recalibrate risk and pricing.

![Venezuela oil tanker seizure] (https://a57.foxnews.com/static.foxnews.com/foxnews.com/content/uploads/2025/12/1200/675/venezuela-oil-tanker-seizure.png?ve=1&tl=1 " ")